- Standard Exness Account Types: Simplicity Meets Power

- Professional Exness Account Types: Precision for Experienced Traders

- Choosing Your Ideal Trading Account: A Quick Guide

- Understanding the Range of Exness Account Types

- Standard Account Options: Approachable and Reliable

- Professional Account Options: Engineered for Performance

- Quick Comparison of Core Exness Account Types

- Key Factors When Choosing Your Exness Account

- Why Different Exness Account Types Matter for Traders

- The Standard Account: Features and Benefits

- Key Features of the Standard Account:

- Benefits for Traders:

- Is the Standard Exness Account Right for You?

- Standard Cent Account: Ideal for Beginners and Small Capital

- Raw Spread Account: Designed for Tight Spreads

- How Raw Spreads Work with Commissions on Exness

- Zero Account: Trading with Zero Spreads Explained

- Pro Account: Advanced Conditions for Experienced Traders

- What Makes the Pro Account Stand Out?

- Who Should Consider the Pro Account?

- Key Features at a Glance

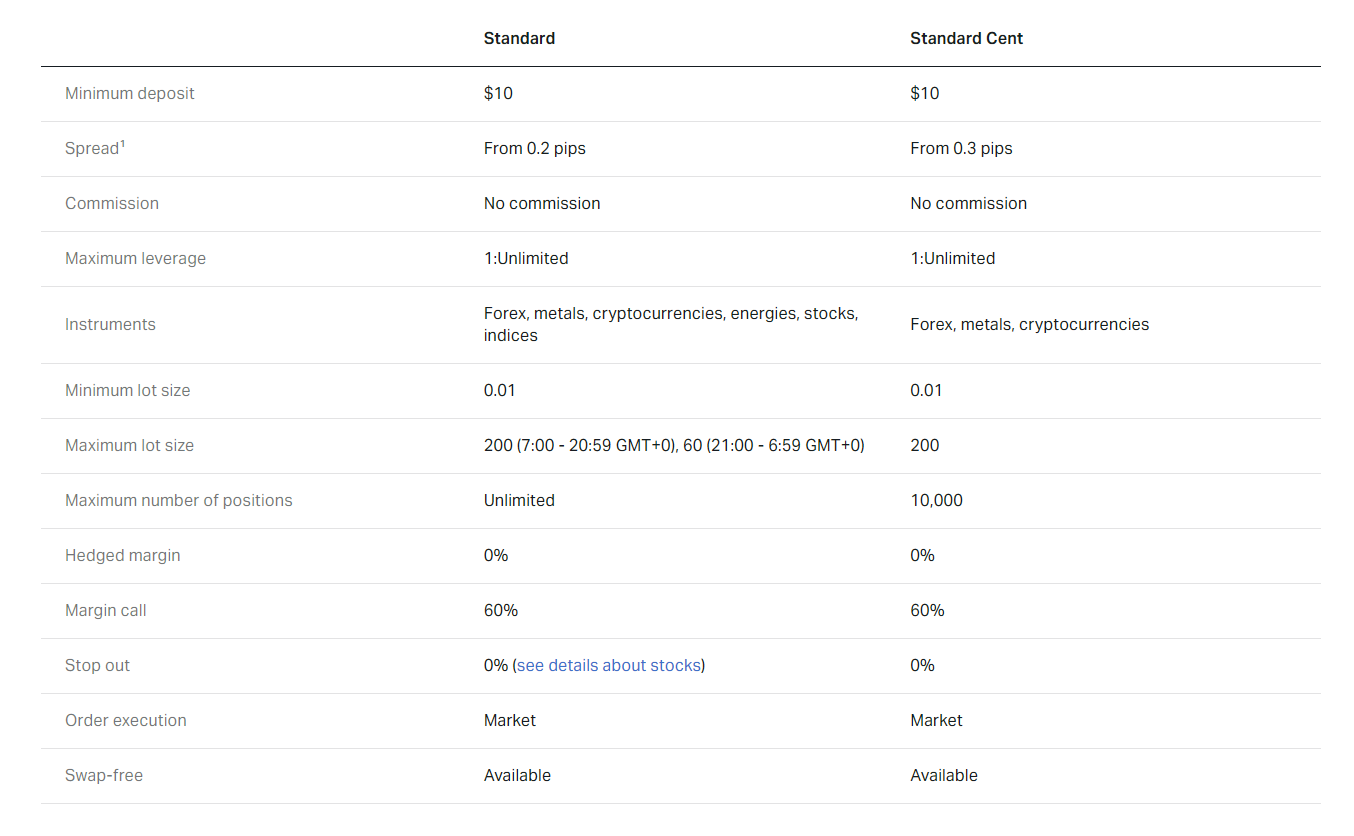

- Comparing Key Features Across Exness Account Types

- Minimum Deposit Requirements for Each Exness Account

- Leverage Options and Margins by Account Type

- Comparing Leverage and Margin Across Exness Account Options

- Trading Instruments Available on Exness Accounts

- Commissions and Spreads: What to Expect

- Decoding Spreads

- Understanding Commissions

- How Exness Account Types Influence Your Costs

- Detailed Breakdown for Each Exness Account Type

- The Standard Account: Your Reliable Starting Point

- The Standard Cent Account: Practice Makes Perfect

- The Raw Spread Account: Precision for Professionals

- The Zero Account: Eliminating Spreads on Key Instruments

- The Pro Account: The Elite Choice for Experienced Traders

- How to Select the Best Exness Account for Your Needs

- Factors to Consider Before Opening an Exness Account

- Step-by-Step Exness Account Registration

- Your Smooth Path to Trading

- Why Quick Registration Matters

- Verifying Your Exness Account: A Quick Guide

- Why Verification Matters

- Documents You’ll Need

- The Verification Steps

- Benefits of a Verified Account

- Funding and Withdrawing from Your Exness Account

- Depositing Funds into Your Exness Account

- Withdrawing Your Earnings

- Key Considerations for Transfers

- Payment Method Overview

- FAQs About Exness Account Types

- What are the primary Exness Account Types available?

- How do I choose the best Exness account for my trading style?

- What are the key differences between Standard and Professional Exness accounts?

- Can I open multiple Exness accounts with different configurations?

- Are there specific Exness Account Types suitable for beginners?

- Frequently Asked Questions

Standard Exness Account Types: Simplicity Meets Power

Are you just embarking on your trading journey or prefer a straightforward, cost-effective approach? Our Standard Exness accounts are ideal. These account types provide a robust yet user-friendly environment, perfect for beginners and those who value simplicity and transparent conditions. They offer a fantastic starting point without overwhelming complexity, allowing you to focus on learning and executing your trades.

- Standard Account: This is our most popular and versatile trading account. It features competitive spreads, no commission on trades, and a low minimum deposit, making it accessible for a wide audience. You gain access to a broad array of instruments, perfect for various trading styles, from day trading to swing trading.

- Standard Cent Account: Specifically designed for new traders or those looking to test strategies with minimal risk. Trades execute in cents, allowing you to practice with smaller volumes and get accustomed to market dynamics without significant capital outlay. It’s an excellent way to gain experience and build confidence.

Both Standard trading accounts offer high leverage and instant withdrawals, ensuring flexibility and convenience as you learn and grow your portfolio.

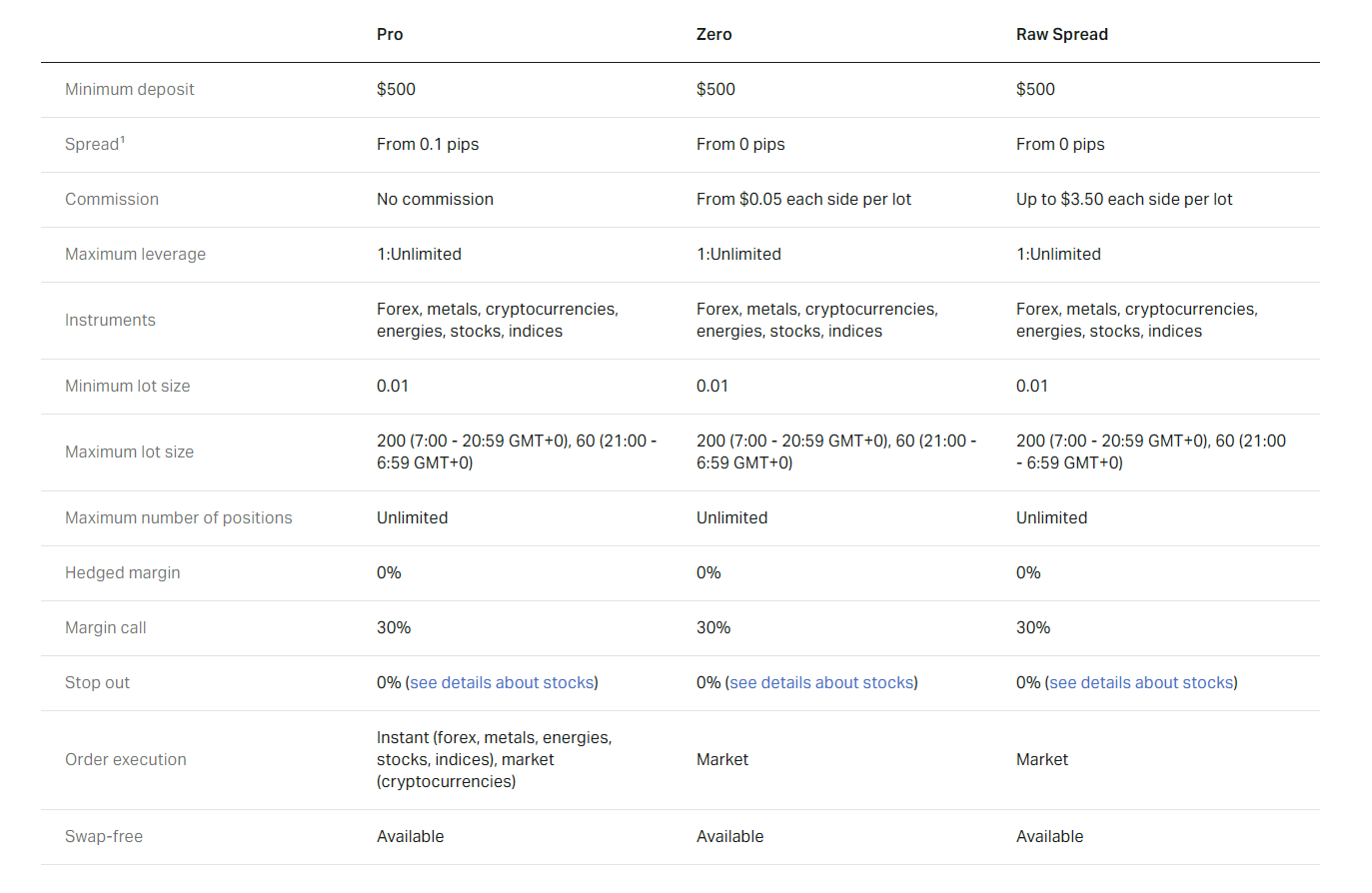

Professional Exness Account Types: Precision for Experienced Traders

For the seasoned trader who demands advanced features, tighter spreads, and optimized execution, Exness provides specialized Professional Exness Accounts. These account types cater to specific, high-volume strategies, offering superior trading conditions for expert advisors, scalpers, and high-frequency traders. Precision and efficiency define these premium forex account options.

- Raw Spread Account: Experience incredibly tight spreads, often starting from 0 pips on major currency pairs, combined with a fixed, low commission per lot per side. This account suits scalpers and high-frequency traders who prioritize minimal spread costs and swift execution.

- Zero Account: Benefit from 0-pip spreads for the top 30 trading instruments for 95% of the trading day, coupled with a small commission. It’s built for those who demand ultimate cost efficiency on specific assets and trade in high volumes.

- Pro Account: This option perfectly balances competitive spreads with commission-free trading. It offers instant execution and is an excellent choice for day traders and swing traders who value predictable costs, fast order fulfillment, and flexibility across various markets.

Choosing Your Ideal Trading Account: A Quick Guide

Selecting the right Exness account type significantly impacts your trading experience and potential profitability. Consider your capital, risk tolerance, and the frequency of your trades. Each of the available trading accounts brings unique benefits to the table. We empower you to make an informed decision that aligns perfectly with your individual needs.

| Consideration | Standard Accounts (e.g., Standard, Standard Cent) | Professional Accounts (e.g., Raw Spread, Zero, Pro) |

|---|---|---|

| Experience Level | Beginner to Intermediate | Experienced to Advanced |

| Trading Volume | Lower to Medium | Medium to High |

| Cost Structure | Wider spreads, no commission | Tighter spreads, often with commission |

| Strategy Focus | General trading, learning, casual | Scalping, EAs, high-frequency, precision |

Think about your long-term goals. Do you need the lowest possible spread, or do you prefer commission-free trading with stable conditions? These diverse forex account options cater to distinct needs, ensuring there is a perfect fit for everyone.

Making an informed choice among the Exness account types empowers you to trade more effectively. Take the time to evaluate what truly aligns with your financial objectives and trading habits. Unlock your full potential with the perfect account today!

Understanding the Range of Exness Account Types

Choosing the perfect Exness account types can significantly impact your trading journey, setting a strong foundation for success. Exness offers a diverse selection of trading accounts, each meticulously crafted to cater to various needs, from those just starting out to seasoned professional traders. Understanding these options empowers you to select the best fit for your unique style and goals.

Exness provides several distinct account types, each featuring unique characteristics regarding spreads, commissions, and execution methods. Grasping these differences is crucial for optimizing your trading strategy and managing costs effectively. We’ll explore the core categories of Exness accounts available, highlighting their key benefits.

Standard Account Options: Approachable and Reliable

For many traders, the journey begins with the accessible Standard account options. These are incredibly popular due to their straightforward structure, ease of use, and broad appeal.

- Standard Account: This serves as a fantastic entry point for most traders. It boasts stable and competitive spreads, requires no commission on trades, and grants access to a wide array of trading instruments. Its user-friendly nature makes it a top choice among Exness account types for those starting their trading career or managing moderate trading volumes.

- Standard Cent Account: Ideal for new traders eager to test strategies with minimal risk. You can trade in cents, allowing for much smaller position sizes and superior risk management without tying up significant capital. This stands as one of the most accessible forex account options for practicing and refining your skills in a live market environment.

Professional Account Options: Engineered for Performance

As your trading experience grows or your strategy demands more specialized conditions, the professional trading accounts step in. These advanced Exness accounts are engineered for efficiency, tighter conditions, and lower costs on higher volumes.

- Raw Spread Account: Designed specifically for traders who prioritize ultra-tight spreads. You will find incredibly low, often zero, spreads on major currency pairs, coupled with a small, fixed commission per lot per side. This setup is highly attractive for scalpers and high-volume traders seeking to minimize their entry and exit costs.

- Zero Account: True to its name, this account offers zero spreads on the top 30 trading instruments for 95% of the trading day. A minimal commission applies, making it another excellent choice for those focused on eliminating spread costs. It represents a robust option among the professional forex account options for algorithmic and high-frequency traders.

- Pro Account: This account strikes an excellent balance, offering consistently tight spreads with zero commission on most instruments. Experienced traders often prefer it for a premium trading environment without explicit commission charges. The Pro account is built for precision and performance across diverse markets.

Quick Comparison of Core Exness Account Types

To help you visualize the differences, here is a concise comparison of the primary Exness account types:

| Account Type | Spreads | Commissions | Ideal For |

|---|---|---|---|

| Standard | Stable, competitive | None | Beginners, general traders |

| Standard Cent | Stable, competitive | None | New traders, risk minimizers |

| Raw Spread | Ultra-low (from 0 pips) | Fixed per lot | Scalpers, high-volume traders |

| Zero | 0 pips (top 30 instruments) | Minimal per lot | Algorithmic traders, high-frequency traders |

| Pro | Tight, competitive | None | Experienced traders, swing traders |

Key Factors When Choosing Your Exness Account

Selecting the right set of Exness account types is a personal and critical decision. Consider these crucial factors carefully before you commit:

- Your Trading Strategy: Are you a scalper who benefits from ultra-tight spreads, a swing trader who values low commissions, or a long-term investor? Your approach dictates the optimal spread and commission structure.

- Capital Availability: Minimum deposits vary across different trading accounts, directly influencing which options are accessible to you.

- Risk Tolerance: The ability to trade in smaller units, such as with the Standard Cent account, can significantly help manage your exposure and build confidence.

- Experience Level: Beginners often find Standard Exness accounts more forgiving and easier to manage, while professional traders leverage the tighter conditions and specialized features of Raw Spread or Zero accounts.

- Overall Trading Costs: Always evaluate how spreads and commissions, combined with swap rates, impact your overall profitability. The best forex account options align perfectly with your cost expectations and trading frequency.

Ultimately, Exness offers a robust selection of account types designed to suit nearly every trader’s ambition and style. Take the time to evaluate your unique trading style, financial goals, and experience level. Understanding each option fully empowers you to make an informed choice, setting a strong foundation for your trading success. Explore the various Exness accounts and find the perfect fit for your ambitions today.

Why Different Exness Account Types Matter for Traders

Your trading journey is unique. A generic account simply won’t cut it. Exness understands this, offering a range of Exness Account Types to suit diverse needs. Choosing the right one significantly impacts your trading experience and potential success. It is not just about opening an account; it is about finding a tailored solution that resonates with your personal trading style and goals.

Think about it: a beginner learning the ropes has different priorities than a seasoned professional managing large portfolios. That is why variety in account types truly makes a difference. Exness’s diverse trading accounts ensure you find a perfect fit for your strategy and comfort level.

“The right account empowers your trading, providing the ideal foundation for your strategy to thrive.”

Let’s look at why these distinct Exness accounts are so vital:

- Tailored Conditions: Different forex account options come with varying spreads, commissions, and leverage. A high-volume trader might prioritize low commissions, while a swing trader might prefer tighter spreads without commissions. Choosing correctly optimizes your operational costs and aligns with your trading frequency.

- Risk Management: Some account types offer features like lower minimum deposits, micro-lots, or different margin call levels. These are ideal for managing risk, especially for new traders. You can start small, learn, and grow confidently without unnecessary pressure.

- Strategy Optimization: Scalpers need lightning-fast execution and razor-thin spreads. Long-term investors might value stable swap rates. The specialized features of various Exness Account Types directly support your unique trading style, allowing your strategy to perform at its peak.

- Accessibility and Growth: Beginners find entry-level trading accounts incredibly accessible, lowering the barrier to entry. As your skills and capital grow, you can seamlessly transition to more advanced exness accounts that offer greater flexibility and higher limits, supporting your evolution as a trader.

Ultimately, selecting the appropriate Exness account type is a strategic decision. It aligns the broker’s offerings with your personal trading goals, ensuring a more efficient and potentially profitable journey.

The Standard Account: Features and Benefits

Embarking on your trading journey requires the right foundation, and among the diverse

Exness Account Types, the Standard Account stands out as a consistently popular choice. It’s designed to offer a balanced and accessible trading experience, making it an excellent starting point for new traders while still providing ample scope for seasoned market participants.

This particular Exness account type strikes a perfect balance between simplicity and powerful functionality. We understand that finding the right match among various

trading accounts can seem daunting, but the Standard Account simplifies that decision by offering clear advantages.

Key Features of the Standard Account:

- Accessible Minimum Deposit: Start trading with a remarkably low initial deposit, removing common barriers to entry. This makes it easy for anyone to explore forex account options.

- Stable Spreads: Benefit from stable and competitive spreads on major currency pairs, indices, and commodities. This predictability helps you manage your trading costs effectively.

- Zero Commission: Enjoy commission-free trading on most instruments. The absence of commission fees on your trades means more of your potential profits stay in your pocket.

- Flexible Leverage: Access dynamic leverage options, allowing you to tailor your risk exposure to suit your strategy and comfort level.

- Wide Range of Instruments: Trade an extensive selection of instruments, including popular forex pairs, cryptocurrencies, indices, and energies. Your trading opportunities are vast.

- Instant Execution: Experience reliable and prompt order execution, crucial for capitalizing on fast-moving markets.

- Platform Compatibility: Seamlessly integrate with industry-leading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the intuitive Exness Terminal.

Benefits for Traders:

Opting for the Standard Account brings several advantages that cater to a broad spectrum of traders:

| Benefit | Description |

|---|---|

| Ideal for Beginners | Its straightforward structure and low entry barrier provide a welcoming environment for those new to the markets. You can learn and grow without significant initial commitments. |

| Cost-Effective Trading | With zero commission and competitive spreads, this account helps you keep your trading costs down, maximizing your potential returns. |

| Versatile Trading Experience | Access to a diverse range of assets means you are not limited to just one market. You can diversify your portfolio and explore different strategies. |

| Reliability and Support | Leverage Exness’s robust infrastructure and dedicated customer support, ensuring a smooth and reliable trading journey. You’re never alone when navigating the markets. |

With zero commission and competitive spreads, this account helps you keep your trading costs down, maximizing your potential returns.

Is the Standard Exness Account Right for You?

Choosing the right trading environment is crucial for your success. Among the various Exness Account Types, the Standard account often stands out as a top pick, especially for those new to the markets or looking for a straightforward, reliable option. But is it truly the best fit for your unique trading style and goals?

The Standard Exness account simplifies your trading journey. It offers a user-friendly platform with competitive conditions, making it accessible to a wide range of traders. You get tight, stable spreads and no commission on trades, which can significantly impact your profitability.

Here’s why many traders gravitate towards the Standard account:

- Low Entry Barrier: Start trading with a minimal deposit, perfect for managing initial risk.

- No Commissions: Keep more of your profits as there are no hidden fees on your trades.

- Stable Spreads: Experience consistent and competitive spreads across major currency pairs and other instruments.

- Flexible Leverage: Access a range of leverage options, allowing you to tailor your risk exposure.

- Wide Asset Selection: Trade a diverse portfolio including forex, cryptocurrencies, metals, and more.

“The Standard account is designed for clarity and ease, providing a solid foundation whether you’re just starting or managing diverse strategies.”

This particular Exness account type is an excellent choice if you’re:

- A beginner taking your first steps into online trading.

- An experienced trader who prefers commission-free transactions.

- Someone testing new strategies without committing large capital.

- Looking for a reliable platform with transparent pricing.

However, it’s also important to consider your specific needs. While ideal for many, professional traders with very high trading volumes or those employing highly specific strategies might explore other Exness accounts offering raw spreads or ultra-low commissions on higher deposits.

To help you decide, here’s a quick overview of what the Standard account brings to the table:

| Pros of the Standard Account | Considerations |

|---|---|

| Accessible with low minimum deposit | Spreads might be slightly wider than raw spread accounts |

| No trading commissions on forex account options | May not be optimal for ultra-high-frequency scalping |

| Suitable for all experience levels | Specific strategies might benefit from other trading accounts |

Ultimately, the Standard Exness account delivers a robust and friendly environment for a broad spectrum of traders. It’s an excellent starting point for many looking to dive into the world of trading. Evaluate your personal goals and trading style, and see if these compelling forex account options align with your vision. Ready to explore more of our trading accounts?

Standard Cent Account: Ideal for Beginners and Small Capital

Embarking on your trading journey can feel overwhelming, especially when navigating the vast world of forex. At Exness, we understand this. That’s why we crafted the Standard Cent Account, specifically designed for those just starting out or traders looking to test strategies with minimal risk. It’s one of the most accessible Exness Account Types available, truly a game-changer for new entrants.

What makes this particular trading account so unique? Instead of trading in standard dollars, it calculates your positions in cents. Imagine opening a trade with a $10 deposit, and you see it reflected as 1000 cents in your account. This setup drastically reduces your exposure, allowing you to experience real market conditions without significant financial pressure. It’s an excellent way to gain practical experience before committing larger capital.

Many new traders often look for forex account options that provide a safe learning environment. The Standard Cent Account delivers precisely that. You can hone your skills, understand market volatility, and get comfortable with trading platforms. It’s perfect for practicing risk management and strategy implementation on a live market, making it one of the most popular Exness accounts for educational purposes.

This particular Exness account type offers a wealth of benefits:

- Reduced Risk: Trade in micro-lots where each pip movement impacts cents, not dollars. This protects your capital while you learn.

- Real Market Experience: Get a genuine feel for live market dynamics, spreads, and execution speeds, unlike a demo account.

- Strategy Testing: Experiment with new trading strategies and indicators in a low-stakes environment.

- Accessibility: With a very low minimum deposit, it’s easy for anyone to get started.

- Part of Comprehensive Exness Account Types: Gain access to all the robust features and support Exness provides across its diverse account options.

Whether you are a complete novice or simply wish to refine your techniques with smaller capital, the Standard Cent Account offers an ideal starting point among our forex account options. It’s a clear pathway to building confidence and understanding without the daunting pressure often associated with larger investment amounts. Explore this outstanding option within our range of trading accounts and begin your journey today!

Raw Spread Account: Designed for Tight Spreads

Are you a seasoned trader who demands precision and minimal trading costs? Then the Raw Spread Account from Exness is engineered precisely for you. This premium option among Exness Account Types stands out for its incredibly tight spreads, starting from a true 0.0 pips on major currency pairs. It’s a favorite among those who prioritize direct market access and seek to minimize their spread expenditure, optimizing their forex account options.

When you choose a Raw Spread Account, you’re opting for a transparent pricing model. Instead of wider spreads, you’ll encounter a small, fixed commission per lot, per side. This structure provides clarity and predictability for your trading strategy, allowing for more precise cost calculations. Many of our professional Exness accounts holders find this particular setup highly beneficial for high-volume trading strategies like scalping or algorithmic trading.

Here’s what truly sets the Raw Spread Account apart:

- Ultra-Low Spreads: Experience spreads starting from 0.0 pips on key instruments, giving you direct access to market pricing. This is critical for strategies sensitive to price fluctuations.

- Clear Commission Structure: A fixed, low commission means you always know your trading costs upfront, making risk management and profitability calculations straightforward.

- Superior Execution: Benefit from lightning-fast order execution, vital for capitalizing on rapid market movements. This responsiveness ensures your trades are placed at the prices you intend.

- Access to a Wide Range of Instruments: Trade major, minor, and exotic currency pairs, cryptocurrencies, metals, and more, all with the advantage of raw spreads.

This Raw Spread Account is particularly well-suited for:

- Scalpers: Those who execute numerous trades to capture small price movements will appreciate the minimal spread impact.

- Day Traders: Individuals who open and close positions within a single day find the predictable costs and tight spreads invaluable.

- Algorithmic Traders: Automated systems thrive on consistent, low-cost execution, making this a prime choice for EA-based strategies.

- Experienced Traders: Professionals seeking the purest form of market access and direct control over their trading costs will find this a powerful tool among trading accounts.

Exploring the various account types available at Exness helps you identify the perfect fit for your individual trading style. If your strategy relies on minimizing spread costs and requires precise execution, the Raw Spread Account is undoubtedly one of the most compelling Exness Account Types to consider. It’s built to empower serious traders, providing an environment where every pip counts.

Ready to experience trading with ultra-tight spreads and transparent commissions? Discover if the Raw Spread Account aligns with your trading ambitions and take the next step towards optimized trading.

How Raw Spreads Work with Commissions on Exness

You crave transparency and predictability in your trading costs, right? Exness understands this, which is why certain Exness Account Types feature a powerful combination of raw spreads and commissions. This model offers a direct approach to pricing, ensuring you know exactly what you pay for each trade.

Here’s how it operates: raw spreads represent the absolute tightest bid-ask prices available directly from liquidity providers. Unlike accounts with marked-up spreads, these are incredibly narrow, often starting from 0.0 pips for major currency pairs. Think of it as getting the market price almost without any added cost within the spread itself.

To facilitate these incredibly tight spreads, a fixed, transparent commission is applied per lot traded. This fee is clearly stated and consistent, making your trading expenses straightforward to calculate. You avoid hidden costs embedded in a wider spread, allowing for clearer financial planning and execution of your strategies across various trading accounts.

This distinct pricing structure often appeals to high-volume traders, scalpers, and those employing expert advisors, as it minimizes the immediate cost of entry into a trade. You get a direct feed, and your trading cost is simply the sum of that raw spread plus the set commission. This setup offers significant benefits for those who prioritize minimal spread impact.

- Unmatched Transparency: See the true market price without hidden markups.

- Predictable Costs: Commissions are fixed per lot, simplifying expense calculation.

- Lower Entry Barriers: Extremely tight raw spreads reduce initial trade cost.

- Ideal for Active Traders: Benefits those executing frequent trades with precision.

When evaluating different exness accounts, understanding this model is crucial. It’s one of several forex account options Exness provides, each designed to meet diverse trading styles and preferences. This approach empowers you to make informed decisions about the best fit for your trading journey.

Zero Account: Trading with Zero Spreads Explained

Are you a meticulous trader who scrutinizes every pip, where even a fraction of a cost can impact your overall profitability? Then the Exness Zero Account might be the strategic advantage you’ve been searching for. Among the diverse Exness Account Types available, this specific offering stands out by tackling one of the biggest trading expenses head-on: the spread.

The Zero Account delivers precisely what its name implies. Experience trading with genuine zero spreads on the top 30 most popular instruments for up to 95% of the trading day. Imagine executing your trades without the immediate hurdle of a spread eating into your potential profits. This makes it an incredibly attractive choice for traders who demand precision and minimal upfront costs.

“For high-volume strategies and expert advisors, minimizing trading costs through zero spreads can significantly enhance performance and bottom-line results.”

This distinct choice among the various account types offers several compelling advantages, especially for active traders:

- Unmatched Cost Efficiency: Experience significantly lower trading costs, particularly beneficial for high-volume strategies like scalping or automated trading.

- Predictable Trading: With zero spreads, your entry and exit points are clearer, leading to more precise execution and simpler strategy planning. This brings greater certainty to your trading accounts.

- Ideal for Specific Strategies: Perfect for high-frequency traders, scalpers, and those employing expert advisors (EAs) where razor-thin spreads are paramount for optimal performance.

- Access to Popular Instruments: Trade major currency pairs and other frequently traded assets with the distinct advantage of zero spreads.

While the Zero Account offers zero spreads, it’s crucial to understand its commission-based model. Instead of a fluctuating spread, you pay a small, fixed commission per lot, per side. This transparent structure allows for better cost forecasting and can often result in overall lower trading expenses compared to accounts with wider, variable spreads. This transparency is a key benefit when evaluating forex account options.

Here’s a quick overview of how the cost components typically compare:

| Cost Component | Zero Account | Standard Account (Typical) |

|---|---|---|

| Spread | From 0.0 pips | Variable (from 0.3 pips) |

| Commission | Yes (fixed, per lot, per side) | No (cost embedded in spread) |

If you’re an experienced trader looking to optimize your strategies by minimizing spread costs, particularly in high-frequency scenarios, then exploring this unique offering among the available exness accounts is a smart move. It provides a unique environment for those who thrive on razor-thin margins and predictable execution.

Ready to unlock a new level of cost-effective and precise trading? Dive into the details of the Exness Zero Account and see how it can empower your trading journey.

Pro Account: Advanced Conditions for Experienced Traders

Ready to elevate your trading journey? The Exness Pro Account stands out among the Exness Account Types, specifically designed for seasoned traders seeking optimal conditions. If you demand precision, competitive pricing, and swift execution, this is your gateway to a more refined trading experience. We understand what experienced traders need, and the Pro Account delivers on every front.

This premium option within our diverse range of trading accounts offers a suite of benefits tailored for those who navigate the markets with confidence. It’s not just another choice among Exness accounts; it’s a strategic advantage for serious participants.

What Makes the Pro Account Stand Out?

- Ultra-Low Spreads: Experience some of the tightest spreads in the industry, often zero on major currency pairs for a significant portion of the trading day. This can dramatically reduce your trading costs.

- No Commissions on Key Instruments: Trade major forex pairs, metals, crypto, and indices without paying any commission. This clarity in pricing helps you manage your strategy without hidden fees.

- Instant Execution: Benefit from instant execution with no requotes, crucial for strategies that rely on precise entry and exit points. Speed matters when market opportunities arise.

- Wide Range of Instruments: Access a comprehensive selection of currency pairs, cryptocurrencies, stocks, indices, and commodities. Diversify your portfolio with confidence.

- Flexibility for Various Strategies: Whether you’re a scalper, day trader, or employ sophisticated algorithmic strategies, the Pro Account provides the infrastructure you need to execute effectively.

Who Should Consider the Pro Account?

The Pro Account is ideal for:

- Traders with extensive market experience.

- Those implementing high-frequency trading or scalping strategies.

- Individuals seeking minimal trading costs through tight spreads and zero commissions on many instruments.

- Traders who prioritize instant order execution without compromise.

Key Features at a Glance

| Feature | Pro Account Condition |

|---|---|

| Minimum Deposit | 1,000 USD (or equivalent) |

| Spreads | From 0.0 pips |

| Commissions | Zero for most instruments |

| Execution Type | Instant execution |

| Stop Out Level | 30% |

Among the various forex account options we provide, the Pro Account consistently receives high praise from traders who appreciate its efficiency and cost-effectiveness. It enables you to focus purely on your trading decisions, knowing that your trading conditions are optimized for performance. We’ve crafted this offering specifically for those who know exactly what they need to succeed in dynamic markets.

Ready to unlock advanced conditions and elevate your trading? Explore the Exness Pro Account today and experience the difference superior trading conditions can make.

Comparing Key Features Across Exness Account Types

Navigating the world of online trading demands precision, and choosing the right platform for your journey is paramount. Understanding the diverse Exness Account Types on offer is your first strategic move. We empower traders with options, ensuring everyone, from beginners to seasoned professionals, finds a perfect fit for their unique trading style and goals. Let’s break down the key features, helping you pinpoint the ideal choice among our robust exness accounts.

Our suite of Exness Account Types generally falls into two main categories: Standard and Professional. Each category is meticulously crafted to serve distinct trading preferences and strategies. Standard accounts, including the popular Standard and Standard Cent options, offer straightforward conditions perfect for those starting out or looking for simplicity. Professional accounts, such as Raw Spread, Zero, and Pro, cater to experienced traders demanding tighter spreads, lower commissions, and specific execution styles.

Here is a quick comparison of key features across our primary Exness Account Types:

| Feature | Standard Account | Raw Spread Account | Pro Account |

|---|---|---|---|

| Minimum Deposit | Low (e.g., $1) | Higher (e.g., $200) | Higher (e.g., $200) |

| Spreads From | Stable, low | 0.0 pips (most of the time) | 0.1 pips |

| Commission | None | Low fixed fee per lot/side | None |

| Execution Type | Market Execution | Market Execution | Market Execution |

| Suitable For | New traders, general use | Scalpers, high-volume traders | Experienced traders, day traders |

Each of these trading accounts boasts specific advantages. For instance, the Standard Account offers highly stable spreads without commissions, making it incredibly accessible for newcomers. Its ease of use and predictable costs help new traders build confidence. On the other hand, Raw Spread accounts present ultra-low spreads, often starting from 0.0 pips on major currency pairs, with a small, transparent commission. This structure significantly benefits high-frequency traders and scalpers who thrive on minimal spread costs.

The Pro Account provides a compelling middle ground for experienced traders seeking competitive, tight spreads and no commission, similar to the Standard but with better pricing. It combines the best of both worlds, offering excellent conditions across various instruments without added per-trade costs. Our comprehensive forex account options ensure you find the perfect blend of features, whether you prioritize zero commissions, razor-thin spreads, or a balanced approach. We empower you to make informed decisions that align with your trading journey and financial objectives.

Choosing the right Exness Account Type directly impacts your trading efficiency and potential profitability. Reviewing these features carefully allows you to match your strategy with the optimal account conditions. Ready to elevate your trading experience? Join us today and discover the power of tailored trading environments designed for your success.

Minimum Deposit Requirements for Each Exness Account

Embarking on your trading journey requires understanding the specifics, and minimum deposit requirements are a crucial starting point. With Exness, you gain access to a range of Exness Account Types designed to suit diverse trading styles and capital levels. Knowing these initial investment thresholds helps you select the perfect fit among the available forex account options, ensuring your journey begins smoothly and confidently.

Exness prides itself on offering flexible trading conditions across its various Exness accounts. Generally, these fall into two main categories: Standard accounts and Professional accounts. Each category offers distinct features, and naturally, different entry points regarding minimum deposits. Your choice of account types can significantly impact your trading experience, so aligning it with your available capital is essential.

Let’s break down the minimum deposit for each of these popular trading accounts. This clear overview empowers you to make an informed decision based on your financial capacity and trading ambitions.

| Exness Account Type | Minimum Deposit (Typically) | Who It’s For |

|---|---|---|

| Standard Account | $10 | Beginners and casual traders |

| Standard Cent Account | $10 | Newcomers practicing with smaller volumes |

| Raw Spread Account | $200 | Experienced traders seeking ultra-low spreads |

| Zero Account | $200 | Traders desiring zero spread on major instruments |

| Pro Account | $200 | Professional traders needing superior execution |

As you can see, Exness provides accessible entry points for all types of traders. Whether you’re just starting with a Standard account or ready for the advanced features of our professional trading accounts, your choice of account types is well-supported. Carefully review these requirements to align your capital with the features of your preferred Exness account. This foundational step is key to unlocking your full trading potential with Exness.

Leverage Options and Margins by Account Type

When you explore the various Exness Account Types, understanding leverage options and margin requirements is absolutely vital. These aren’t just technical terms; they’re core components that directly impact your trading power and risk exposure. Choosing the right account type means aligning these features with your trading strategy and financial comfort level. Let’s demystify how leverage and margin operate across different Exness accounts.

Leverage acts like a financial magnifyer, empowering you to control larger positions in the market with a relatively small amount of capital. For instance, with 1:100 leverage, a $100 deposit can control a $10,000 position. This incredible power, however, comes with amplified risk. Margin, on the other hand, is the amount of collateral you need to set aside to open and maintain a leveraged position. It’s not a fee, but rather a portion of your account equity held by the broker to cover potential losses.

Exness distinguishes itself with a dynamic leverage system, a smart approach across many of its trading accounts. This means your maximum available leverage can adjust based on your account equity, the specific financial instrument you’re trading, and market conditions. This adaptable system offers flexibility while also promoting responsible trading practices. It’s a critical feature that differentiates various Exness Account Types, helping you manage risk effectively as your equity grows or shrinks.

Comparing Leverage and Margin Across Exness Account Options

Different Exness accounts are tailored for diverse trading needs, and their leverage and margin characteristics reflect this. While the allure of high leverage is strong, it’s crucial to grasp its implications for your margin requirements and overall risk. Let’s look at how specific Exness account types handle these aspects:

- Standard Account: A popular choice for many traders, these account types generally offer competitive dynamic leverage, making them suitable for a wide range of strategies. Margin requirements here are typically straightforward, providing an accessible entry point for new and experienced traders alike.

- Raw Spread Account: Geared towards experienced traders seeking ultra-low spreads, Raw Spread accounts also provide robust leverage. However, given their focus on tight spreads and potentially higher volume trading, understanding the specific margin conditions tied to your trading volume and chosen instruments is paramount.

- Zero Account: Similar to Raw Spread accounts in offering zero spreads on major pairs for much of the trading day, Zero accounts also feature substantial leverage options. Traders using these exness accounts must meticulously monitor their margin levels due to the nature of their high-frequency strategies.

- Pro Account: Tailored for professional traders, Pro accounts combine impressive dynamic leverage with competitive spreads and commission structures. The margin requirements are designed to support more advanced strategies and larger position sizes, enabling seasoned traders to execute their plans with precision.

To give you a clearer perspective, here’s a simplified overview:

| Exness Account Type | General Leverage Availability | Key Margin Consideration |

|---|---|---|

| Standard Account | Dynamic, often very high (equity-dependent). | Lower initial margin for smaller trade sizes. |

| Raw Spread Account | Dynamic, highly competitive. | Careful margin management due to potential high volume. |

| Zero Account | Dynamic, supports active trading. | Crucial for maintaining positions with zero spreads. |

| Pro Account | Dynamic, tailored for professionals. | Supports larger positions with appropriate margin. |

Understanding these nuances among the various trading accounts empowers you to make an informed decision. Remember, while leverage can significantly amplify potential profits, it equally magnifies potential losses. Diligent margin management and a clear grasp of your chosen forex account options are foundational to sustainable trading success. Explore the detailed specifications for each Exness Account Type to find your perfect match.

Trading Instruments Available on Exness Accounts

Opening an account with Exness immediately unlocks a world of diverse trading opportunities. We know traders seek flexibility and breadth, and our various Exness account types deliver exactly that. Whether you are exploring standard or professional trading accounts, you gain access to an impressive array of financial instruments designed to suit every strategy.

Our comprehensive selection ensures you can diversify your portfolio and capitalize on different market conditions. Each of our Exness accounts empowers you to explore markets with confidence. Here’s a look at the primary categories of trading instruments you can access:

- Forex (Foreign Exchange): Trade major, minor, and exotic currency pairs. This is the world’s largest and most liquid market, offering continuous opportunities around the clock. Our forex account options provide competitive spreads and rapid execution for hundreds of pairs.

- Metals: Dive into precious metals like Gold (XAUUSD), Silver (XAGUSD), and Platinum. These assets often serve as safe-haven instruments or inflation hedges, reacting uniquely to global economic shifts.

- Cryptocurrencies: Engage with popular digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrency trading provides access to an innovative and highly dynamic market, ideal for those seeking volatility and growth potential.

- Energies: Trade commodities like Crude Oil (USOIL, UKOIL) and Natural Gas. These instruments react strongly to geopolitical events, supply-demand dynamics, and global economic forecasts.

- Indices: Speculate on the performance of global stock markets without buying individual stocks. This includes major indices like the S&P 500, Dow Jones, FTSE 100, and DAX 30, offering broad market exposure.

- Stocks: Gain exposure to the shares of leading companies across various sectors. Direct stock trading allows you to invest in specific companies you believe in, participating directly in their market performance.

Each of our Exness account types provides unique benefits and tailored conditions for trading these instruments. For instance, different account types might offer varying leverage options, commission structures, or spread conditions depending on the instrument. We empower you to choose the specific Exness accounts and forex account options that best align with your trading style, risk tolerance, and financial goals, ensuring a seamless and effective experience across all available assets.

Commissions and Spreads: What to Expect

Understanding commissions and spreads is crucial for any trader navigating the financial markets. These are direct costs associated with your trades, impacting your overall profitability. At Exness, we believe in transparency, offering a clear view of these charges across our diverse Exness Account Types. Your choice of exness accounts directly influences the fee structure you encounter, so let’s break it down.

Decoding Spreads

The spread represents the difference between the bid (buy) and ask (sell) price of a financial instrument. It’s essentially the market maker’s compensation. Here’s what you need to know:

- Variable vs. Stable Spreads: Many instruments feature variable spreads that fluctuate with market volatility. However, Exness often provides remarkably stable and tight spreads, especially on major currency pairs, ensuring predictable trading conditions even during busy periods.

- Instrument Specifics: Spreads vary significantly depending on the asset you trade. Forex majors typically have the tightest spreads, while exotic pairs, cryptocurrencies, or commodities might see wider differences.

- Account Type Impact: Different account types offer distinct spread conditions. Some are designed for extremely tight spreads, while others bundle the cost into a slightly wider spread without a separate commission.

Understanding Commissions

A commission is a direct fee charged for executing a trade, usually a fixed amount per lot traded or a percentage of the trade value. Not all trading accounts carry commissions:

- Commission-Free Trading: Our popular Standard account options, for instance, are commission-free. Here, the trading cost is built entirely into the spread, making it straightforward for many traders.

- Commission-Based Trading: For those seeking ultra-low spreads, our Raw Spread and Zero exness accounts often feature a small, transparent commission per lot per side. This setup is highly attractive to scalpers, high-volume traders, and those employing expert advisors who prioritize minimal spreads.

How Exness Account Types Influence Your Costs

We’ve tailored our forex account options to suit various trading styles and capital sizes. Here’s a quick look at how commissions and spreads play out across our core offerings:

| Account Type | Typical Spreads | Commissions | Best For |

| Standard Account | Competitive & stable | None | Beginners & casual traders |

| Raw Spread Account | Zero or near-zero | Low, fixed per lot | High-volume traders, scalpers |

| Zero Account | Zero on top 30 instruments (often more) | Low, fixed per lot | Traders prioritizing zero spreads |

Choosing the right account means aligning its cost structure with your trading strategy. For active traders, the Raw Spread and Zero accounts offer the lowest possible spreads, offsetting the minimal commission with better entry and exit points. For those who prefer simplicity and fewer calculations, the Standard account provides a clear, spread-only cost.

We are dedicated to offering competitive conditions that empower your trading journey. Explore the specifics of each of our Exness Account Types to find the perfect match for your financial goals and start experiencing truly transparent trading today.

Detailed Breakdown for Each Exness Account Type

Choosing the right trading environment forms the bedrock of your success. Exness understands this deeply, offering a range of robust Exness Account Types crafted to suit every trader’s unique style, experience, and capital. Let’s peel back the layers and examine the specific advantages of each option among the various Exness accounts available.

The Standard Account: Your Reliable Starting Point

This account consistently ranks as our most popular choice, perfect for traders just embarking on their forex journey or those who value simplicity and predictability. It offers a balanced set of features without complex conditions.

- Accessibility: Begin trading with a low minimum deposit, opening doors to the global markets for everyone.

- Predictable Costs: Enjoy stable spreads, ensuring transparent trading expenses without hidden fees.

- No Commission: Trade without incurring commission charges per lot, simplifying your cost calculations.

- Flexible Leverage: Access high leverage options to amplify your trading potential responsibly.

The Standard Account truly embodies ease of use, making it an excellent gateway to explore the world of forex account options.

The Standard Cent Account: Practice Makes Perfect

For absolute beginners looking to gain real-market experience with minimal risk, the Standard Cent Account is an invaluable tool. It allows you to trade in micro-lots (cent lots), providing a cushioned entry into live trading.

- Risk Mitigation: Trade smaller volumes, significantly reducing your exposure while you learn the ropes.

- Authentic Practice: Experience genuine market conditions, emotions, and execution without requiring substantial capital.

- Strategy Testing: Ideal for back-testing and refining your trading strategies in a live environment before scaling up.

This account empowers new traders to build confidence and develop essential skills in a safe, controlled setting.

The Raw Spread Account: Precision for Professionals

Designed with the discerning, high-volume trader in mind, the Raw Spread Account delivers exactly what its name suggests: raw, interbank spreads. This option focuses on providing the absolute tightest pricing available.

| Feature | Benefit for Traders |

|---|---|

| Raw Spreads | Access spreads starting from 0.0 pips, directly from liquidity providers. |

| Fixed Commission | Transparent, low commission charged per lot, ensuring clear trading costs. |

| Fast Execution | Experience rapid order execution, crucial for high-frequency strategies and scalping. |

If your strategy thrives on razor-thin price differences and you trade substantial volumes, the cost efficiency of these trading accounts becomes a significant advantage.

The Zero Account: Eliminating Spreads on Key Instruments

The Zero Account is a game-changer for traders who prioritize eliminating spread costs on specific, frequently traded instruments. It offers zero spread on the top 30 trading instruments for 95% of the trading day.

“Minimizing variable costs can dramatically improve profitability for high-frequency strategies. The Zero Account directly addresses this need by offering a spread-free environment on key assets.”

- Zero Spread Advantage: Trade major currency pairs and other popular instruments without a spread for the majority of the trading session.

- Competitive Commission: A small, fixed commission applies, making overall trading costs highly competitive.

- Optimized for Specific Strategies: Perfect for scalpers, algorithmic traders, and anyone focused on major pairs where every pip counts.

This specialized option among the Exness Account Types allows you to execute trades with extreme precision on your preferred assets.

The Pro Account: The Elite Choice for Experienced Traders

The Pro Account is tailored for professional traders seeking premium conditions across the board. It combines ultra-tight spreads with commission-free trading on most instruments, delivering a truly superior experience.

- Ultra-Tight Spreads: Benefit from spreads often as low as 0.1 pips on major currency pairs.

- Commission-Free Trading: Enjoy zero commission on a wide array of instruments, simplifying your trading calculations.

- Instant Execution: Experience instant market execution for all orders, minimizing slippage and ensuring your trades fill precisely when you want them to.

- Versatility: Suitable for diverse trading styles, including day trading, swing trading, and news trading, thanks to its exceptional conditions.

For those who demand excellence in execution and pricing, the Pro Account stands out as the ultimate choice among the diverse forex account options that Exness provides.

How to Select the Best Exness Account for Your Needs

Choosing the right trading environment is crucial for your success in the financial markets. Exness offers a diverse range of Exness Account Types, each designed to suit different trading styles and experience levels. But with so many excellent options, how do you pinpoint the perfect fit for your unique needs? Let’s break it down.

First, truly understand your trading profile. This self-assessment is the foundational step toward making an informed decision about your trading accounts.

- Experience Level: Are you a novice just starting out, or a seasoned pro with years of market experience? Beginners might prefer simpler structures, while advanced traders often seek more specialized features.

- Capital & Risk Tolerance: How much capital do you plan to deposit? What is your comfort level with risk? Some account types cater to smaller deposits, offering a gentle entry point. Others are tailored for larger volumes and sophisticated strategies.

- Trading Strategy: Do you scalp, day trade, swing trade, or invest long-term? Your strategy dictates your need for tight spreads, low commissions, fast execution, or specific instrument access.

- Instruments You Trade: Focus on forex, cryptocurrencies, metals, or stocks? Ensure your chosen account provides optimal conditions for your preferred assets.

Next, grasp the key factors differentiating the various Exness Account Types. Exness primarily categorizes its forex account options into two main groups: Standard Accounts and Professional Accounts. Understanding the core differences helps you narrow your search.

| Feature | Standard Account Focus | Professional Account Focus |

|---|---|---|

| Spreads | Stable, competitive spreads | Ultra-low spreads (often zero on major pairs) |

| Commissions | No commissions (spread-based) | Commission per lot (on some types) |

| Minimum Deposit | Lower initial requirement | Higher initial requirement (for some types) |

| Execution | Reliable market execution | Lightning-fast execution, no requotes |

For instance, if you are a high-frequency trader or a scalper, an account with ultra-low spreads and potentially a commission might be more cost-effective. Conversely, for those who trade less frequently or prefer a straightforward fee structure, a commission-free standard account often proves ideal among the various exness accounts.

Finally, consider these practical tips to finalize your choice among the various account types:

- Start with a Demo Account: Always test the waters first. A demo account lets you experience the trading environment without any financial risk.

- Review Trading Conditions: Carefully examine the detailed specifications for each account. Look at spreads, commissions, leverage, margin call levels, and available trading instruments.

- Factor in Customer Support: Excellent support makes a significant difference. Ensure your broker is responsive and helpful, especially when you navigate new platforms and features.

- Long-Term Goals: Think about where you want your trading journey to go. Choose an account that can grow with you, or one that offers a clear upgrade path as your skills and capital increase.

“The best Exness account isn’t about having the most features; it’s about having the right features for your specific trading goals.”

Selecting the best Exness account is a personalized process. By thoughtfully evaluating your trading style and comparing the unique features of different Exness Account Types, you empower yourself to choose a platform that truly supports your success. Get ready to trade with confidence!

Factors to Consider Before Opening an Exness Account

Selecting the right trading account is a crucial step for any trader. It directly impacts your trading experience and potential success. Before you jump in, carefully assess these key factors to ensure you choose one of the Exness account types that perfectly aligns with your trading goals and style.

Here are the essential considerations:

- Your Trading Strategy: Are you a scalper, day trader, or long-term position holder? Different strategies require specific features. For instance, scalpers often prioritize ultra-low spreads, which certain Exness Account Types deliver. Swing traders might focus more on swap rates and available instruments.

- Experience Level: New to the world of forex? Consider forex account options designed for beginners, often featuring micro-lots and simpler structures. Experienced traders might prefer advanced trading accounts with raw spreads and greater flexibility.

- Initial Deposit: Every account type has a minimum deposit requirement. Evaluate your budget and choose an account that fits comfortably within your financial capacity. Don’t overcommit; start with what you are comfortable risking.

- Spreads and Commissions: These trading costs significantly affect your profitability. Compare the typical spreads and commission structures across the various Exness accounts. Some accounts offer zero-spread options, while others have competitive commissions on trades.

- Available Trading Instruments: What do you plan to trade? Forex pairs, cryptocurrencies, stocks, indices, or commodities? Ensure your chosen account provides access to the financial instruments you wish to trade. A broader selection gives you more market opportunities.

- Leverage Options: Leverage amplifies both potential profits and losses. Understand the maximum leverage offered by different trading accounts and how it aligns with your risk tolerance. Higher leverage demands careful risk management.

- Execution Speed: Fast trade execution is vital, especially for strategies like scalping. Research the typical execution speed associated with the different Exness Account Types. Slippage can eat into profits if execution is slow.

- Customer Support: Quick and reliable customer service is invaluable. When questions or issues arise, you want prompt and effective assistance. Consider the quality and availability of support for the specific Exness accounts you are evaluating.

Taking these factors into account helps you make an informed decision, setting a strong foundation for your trading journey with Exness.

Step-by-Step Exness Account Registration

Ready to elevate your trading journey? Getting started with Exness is straightforward, opening doors to a world of diverse financial instruments and superior trading conditions. Understanding the various Exness account types and navigating the registration process efficiently ensures you pick the perfect fit for your trading style. Let’s walk through each simple step to get your Exness account up and running.

Your Smooth Path to Trading

We’ve streamlined the registration to make it incredibly user-friendly. Forget complex forms and endless waiting. Our process is designed for speed and clarity, allowing you to focus on what matters most: your trades. Here’s how you can join our global community of traders and explore the excellent forex account options we provide.

- Visit the Official Exness Website: Your first step is to head over to the Exness homepage. Look for the prominent “Open Account” or “Register” button – it’s usually front and center.

- Provide Basic Details: You’ll enter your country of residence, email address, and create a strong password. This initial setup is quick and secure, laying the foundation for your new trading accounts.

- Verify Your Email or Phone: Exness sends a verification code to either your email or phone number. Enter this code to confirm your contact details and proceed to the next stage.

- Choose Your Account Type: This is a crucial step where you select from our range of Exness account types. Whether you’re a beginner or an experienced pro, we offer various options like Standard, Raw Spread, Pro, and Zero accounts, each designed with unique features and commission structures. Consider your trading strategy and risk tolerance when making this choice among the excellent account types available.

- Complete Your Profile: You will provide more personal information, including your full name, date of birth, and address. This helps us comply with regulatory requirements and ensure a secure trading environment for all our clients.

- Verify Your Identity and Residency (KYC): To ensure the highest level of security and compliance, you’ll need to upload documents proving your identity (like a passport or national ID) and residency (like a utility bill or bank statement). This Know Your Customer (KYC) process is standard practice and keeps your funds safe.

- Make Your First Deposit: Once your profile is complete and verified, you are ready to fund your account. Exness offers a wide array of convenient deposit methods, allowing you to choose what works best for you.

“Choosing the right Exness account is as important as the registration itself. Take a moment to understand the features of each to maximize your trading potential.”

Why Quick Registration Matters

We understand that time is money in the financial markets. Our efficient registration process means less time on paperwork and more time focused on market analysis and executing trades. You get immediate access to powerful platforms and competitive trading conditions.

Getting started with your Exness accounts is the first exciting leap into your trading career. Follow these simple steps, select the Exness account types that fit your needs, and unlock your trading potential today!

Verifying Your Exness Account: A Quick Guide

Verification is a vital step for any trader at Exness. It ensures the security of your funds and compliance with financial regulations. Completing this process grants you full access to all features and services, including the various Exness Account Types available. Don’t skip this crucial stage; it unlocks your complete trading potential.

Why Verification Matters

Understanding why verification is essential gives you confidence in the process. It’s not just a formality; it’s a foundation for secure and compliant trading.

- Enhanced Security: Verification protects your funds and personal data against unauthorized access.

- Regulatory Compliance: It helps Exness meet international financial standards and Anti-Money Laundering (AML) regulations.

- Full Functionality: A verified account unlocks all trading features, withdrawal options, and higher deposit limits.

- Access to All Account Types: Verification ensures you can seamlessly use different trading accounts and explore various forex account options without restrictions.

Documents You’ll Need

To verify your Exness accounts, you typically need two main types of documents: Proof of Identity (POI) and Proof of Residence (POR). Gather these before you start the process to make it smooth and quick.

Proof of Identity (POI) – One of these:

- International Passport (the page with your photo and personal details)

- National ID Card (both front and back sides)

- Driving License (both front and back sides)

Proof of Residence (POR) – One of these, not older than 6 months:

- Utility Bill (electricity, water, gas, internet – showing your address)

- Bank Statement (displaying your name and address)

- Tax Statement (issued by a government body)

The Verification Steps

Once you have your documents ready, the verification process is straightforward and user-friendly. Just follow these steps:

- Login to Your Personal Area: Access your secure account on the Exness website.

- Navigate to Verification: Find the “Verification” section within your Personal Area. You’ll see clear instructions there.

- Upload Documents: Upload clear, high-resolution images of your chosen POI and POR documents. Ensure all four corners of the document are visible and all text is perfectly readable.

- Submit for Review: Confirm your submission. Exness usually reviews your documents quickly, often within a few minutes or hours.

- Receive Confirmation: You will get an email notification once your verification is complete.

Benefits of a Verified Account

A fully verified account offers significant advantages. It’s more than just a formality; it empowers your trading experience across all Exness Account Types.

| Feature | Unverified Account | Verified Account |

|---|---|---|

| Deposits | Limited amounts | Unlimited amounts |

| Withdrawals | Restricted or unavailable | Full access to withdrawals |

| Trading Volume | Capped limits | Higher trading limits |

| Access to Trading Accounts | Limited selection | Full range of forex account options |

Always provide clear, untampered documents. Blurry images, cropped edges, or expired documents are common reasons for verification delays. Patience and precision lead to a swift approval for your Exness accounts.

Funding and Withdrawing from Your Exness Account

Managing your capital efficiently is just as vital as your trading strategy. At Exness, we understand that seamless funding and reliable withdrawals are cornerstones of a positive trading experience. Whether you’re exploring the different Exness Account Types or already an active trader, our robust payment system ensures your funds are always accessible and secure. We’ve designed our processes to be straightforward, giving you peace of mind.

Depositing Funds into Your Exness Account

Depositing money into your Exness accounts is a quick and secure process. We offer a wide array of payment methods, ensuring you find an option that suits your needs, no matter where you are in the world. Our system supports instant deposits for many methods, meaning you can fund your account and start trading without delay. We also prioritize the security of your transactions with advanced encryption and fraud prevention measures. You can easily select your preferred currency for deposits, often avoiding conversion fees on your end.

Withdrawing Your Earnings

When it’s time to realize your profits, our withdrawal process is equally efficient. We believe you should have fast access to your earnings. Our system processes withdrawals swiftly, often instantly for many methods, after a brief review period. We support the same diverse range of options for withdrawals as we do for deposits, giving you flexibility. Regardless of your chosen trading accounts, we ensure transparency throughout the withdrawal journey, providing you with real-time updates on your transaction status.

Key Considerations for Transfers

Understanding the following aspects will help you manage your funds with maximum efficiency:

- Payment Method Variety: We offer numerous options including bank cards, e-wallets, and bank transfers, catering to diverse preferences.

- Processing Times: Many deposits and withdrawals are processed instantly or within minutes, especially for electronic payment systems. Bank transfers may take longer.

- Fees: Exness covers many transaction fees, offering zero-commission deposits and withdrawals for a wide range of methods. Check specific details for your chosen method.

- Currency Options: You can often deposit and withdraw in your local currency or a major international currency, reducing conversion hassles.

- Verification Requirements: To maintain the highest security standards and comply with regulations, you may need to complete account verification before making withdrawals. This protects your funds and ensures regulatory compliance across all forex account options.

Payment Method Overview

Here is a quick look at typical processing times for popular payment methods:

| Method | Deposit Time | Withdrawal Time |

|---|---|---|

| Bank Cards (Visa/Mastercard) | Instant | Instant – 7 Business Days |

| E-wallets (Skrill, Neteller, etc.) | Instant | Instant |

| Bank Transfer | 1-3 Business Days | 1-7 Business Days |

We continually optimize our payment infrastructure to give you the best possible experience. Choosing between our different account types means you gain access to reliable and efficient funding and withdrawal options, empowering you to manage your finances with ease and confidence. Take the next step and explore the seamless financial operations Exness provides.

FAQs About Exness Account Types

Navigating the world of online trading means finding a platform that truly fits your style and goals. At Exness, we understand that one size does not fit all. That’s why we offer a diverse range of Exness Account Types designed to cater to every trader, from the absolute beginner to the seasoned professional. If you have questions about choosing the right fit, you’re in the perfect place! Let’s dive into some of the most frequently asked questions about our various trading accounts.

What are the primary Exness Account Types available?

We’ve streamlined our offerings into two main categories: Standard Accounts and Professional Accounts. Each category offers distinct advantages, ensuring you find the ideal setup for your trading journey. Understanding these account types is crucial for making an informed decision about your forex account options.

- Standard Accounts: Perfect for new traders and those who prefer straightforward execution. These include the Standard and Standard Cent accounts. They offer market execution, stable spreads, and no commission on most instruments.

- Professional Accounts: Designed for experienced traders seeking specific trading conditions. This category includes Raw Spread, Zero, and Pro accounts, each tailored for different strategies and trading volumes.

How do I choose the best Exness account for my trading style?

Selecting the right Exness account depends entirely on your experience level, trading strategy, and capital. Consider these factors:

| Factor | Consideration |

|---|---|

| Experience Level | New to trading? A Standard account offers simplicity. Experienced? Explore Professional Exness accounts for tighter spreads or specific execution models. |

| Trading Strategy | Are you a scalper, swing trader, or long-term investor? Scalpers often prefer Raw Spread or Zero accounts due to very low spreads, while swing traders might find Standard or Pro accounts suitable. |

| Capital | Minimum deposit requirements vary across account types. Standard Cent allows trading with smaller volumes, ideal for practicing. |

Think about what matters most to you: low spreads, zero commissions, or micro-lot trading. This helps narrow down the best trading accounts for your needs.

What are the key differences between Standard and Professional Exness accounts?

The main distinctions lie in execution, spreads, and commissions. Standard account types typically feature wider, stable spreads with no commission per lot on most instruments. Professional Exness accounts, on the other hand, often boast tighter spreads, sometimes even zero on major pairs, but may include a commission per lot, depending on the specific account type within the professional category.

For example, a Raw Spread account offers ultra-low raw spreads plus a small commission, while a Pro account provides competitive spreads with no commission. These varied forex account options ensure every trader can find a fit.

Can I open multiple Exness accounts with different configurations?

Absolutely! Many traders choose to diversify their strategies by opening several Exness accounts. You can have a Standard account for one strategy and a Raw Spread account for another, all under the same personal area. This flexibility allows you to test different approaches or manage various portfolios efficiently. You get to control your diverse portfolio of trading accounts with ease.

Are there specific Exness Account Types suitable for beginners?

Yes, absolutely! For those just starting their trading journey, the Standard and Standard Cent account types are highly recommended. The Standard Cent account, in particular, allows you to trade with micro-lots (cents), significantly reducing risk while you learn the ropes. It’s a fantastic way to gain real market experience without committing substantial capital. These introductory trading accounts provide a forgiving environment for new learners.

Ready to explore these options further? Simply navigate to our account opening section and discover the Exness Account Types that align with your trading ambitions!

Frequently Asked Questions

What are the main types of Exness accounts available?

Exness offers two primary categories: Standard Accounts (including Standard and Standard Cent) for beginners and general traders, and Professional Accounts (including Raw Spread, Zero, and Pro) for experienced traders seeking specialized conditions.

Which Exness account is best for beginners?

The Standard Account and especially the Standard Cent Account are ideal for beginners. The Standard Cent allows trading with micro-lots, significantly reducing risk while gaining real market experience.

How do Raw Spread and Zero accounts differ from Standard accounts?

Raw Spread and Zero accounts are Professional accounts designed for experienced traders. They offer ultra-low spreads (often 0 pips) but typically involve a small commission per lot, whereas Standard accounts have slightly wider, stable spreads with no commissions.

Can I have multiple Exness accounts with different features?

Yes, you can open several Exness accounts under the same personal area. This allows you to use different account types for various trading strategies or to manage diverse portfolios efficiently.

What is the minimum deposit for Exness account types?

Minimum deposits vary across account types. Standard and Standard Cent accounts typically require a low minimum deposit (e.g., $10), while Professional accounts like Raw Spread, Zero, and Pro usually have a higher minimum deposit (e.g., $200).