Understanding the landscape of forex trading in China presents unique challenges and significant opportunities for global platforms. Many traders actively seek reliable avenues for financial market participation. Exness China represents a focal point for those exploring these possibilities, offering robust trading conditions amidst a complex regulatory environment. The Chinese financial market is dynamic, characterized by rapid growth and an evolving framework for international participation. It is crucial for anyone engaging in trading China to understand the nuances that define this unique economic sphere.

Choosing the right platform is paramount. Traders need a service provider that understands their needs and offers competitive conditions. As a china broker, a firm must provide high liquidity, transparent execution, and accessible customer support tailored to the local user base. Exness strives to meet these expectations, focusing on delivering a seamless trading experience.

Here are key aspects traders often consider when evaluating Exness’s offerings in the Chinese market:

- Competitive Spreads: Access to tight spreads on major currency pairs, helping to minimize trading costs.

- Fast Execution: Emphasis on rapid order execution, which is vital in volatile markets.

- Localized Support: Availability of customer service that understands the specific needs and language of Chinese traders.

- Variety of Instruments: Beyond forex, access to a diverse range of CFDs including commodities, indices, and cryptocurrencies.

- Advanced Trading Platforms: Support for popular platforms like MetaTrader 4 and MetaTrader 5, familiar to many global traders.

Navigating the intricacies of the Chinese market requires diligence and an informed approach. While direct international broker operations face regulatory hurdles, traders from China often find pathways to engage with global forex markets. The focus remains on empowering individuals with tools and resources to participate effectively.

“Successful forex trading in China hinges on informed decisions and a reliable trading partner. Understanding local specifics while leveraging global expertise is key.”

Ultimately, for those interested in Exness China, the value lies in a blend of strong trading conditions, technological stability, and a commitment to trader satisfaction. This combination is essential for anyone looking to navigate the exciting world of currency trading from within or related to the Chinese market.

- Understanding Exness’s Presence in the Asian Market

- Is Exness Accessible for Traders in China?

- Key Considerations for Traders in China

- Direct Access vs. VPN Considerations for Exness

- Regulatory Landscape for Forex Trading in China

- People’s Republic of China Regulations on Online Trading

- Key Regulatory Authorities and Their Roles:

- Navigating the Grey Areas for International Brokers like Exness

- The Regulatory Labyrinth for China Forex

- Key Challenges for Global Brokers in China

- How Brokers Adapt and Engage

- The Enduring Appeal for Traders

- Key Features and Advantages of Exness for Chinese Clients

- Unparalleled Localized Support and Accessibility

- Competitive Trading Conditions for the China Forex Market

- Robust Security and Reliability

- Deposit and Withdrawal Options for Exness China Users

- Popular Local Payment Methods and E-wallets

- Multilingual Customer Support for Chinese Traders

- Why Native Language Support Matters

- Seamless Support Channels

- Trading Platforms Available to Exness China Clients

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Exness Terminal (Web Terminal)

- Mobile Trading Applications

- Account Types and Tailored Trading Conditions

- Key Features of Our Tailored Conditions:

- Leverage, Margin, and Trading Limits

- Spreads, Commissions, and Trading Costs

- Understanding Spreads: Your First Cost

- Unpacking Commissions

- Other Potential Trading Costs

- Security, Trust, and Fund Protection at Exness

- Segregated Client Accounts Policy

- Step-by-Step Guide to Opening an Exness Account from China

- 1. Prepare Your Documents

- 2. Start Your Registration Online

- 3. Complete Account Verification (KYC)

- 4. Fund Your Exness Account

- 5. Start Trading

- Overcoming Potential Connectivity Challenges

- Why Connectivity Matters for China Forex Trading

- Practical Steps to Enhance Your Trading China Connection

- How a Leading China Broker Addresses Stability

- Exness China: Comparison with Local Brokerage Services

- The Future of Exness Operations in the Chinese Market

- Key Pillars for Success in China:

- Opportunities and Considerations for Exness China:

- Frequently Asked Questions

Understanding Exness’s Presence in the Asian Market

Asia truly stands as a pivotal and rapidly evolving landscape for the global financial markets. Its vast economies and an ever-growing base of informed investors present immense opportunities. Exness has actively cultivated a strong presence across this vibrant continent, meticulously adapting its services to meet the specific requirements of Asian traders. We observe significant engagement and immense potential across various nations, each bringing its own distinct market characteristics.

Focusing on a key market like China, Exness demonstrates a clear commitment to understanding and serving local trader needs. When we discuss Exness China, we are highlighting a dedicated effort to provide robust and localized trading solutions. The demand for sophisticated financial instruments, particularly within the dynamic realm of china forex, continues its strong ascent, attracting both experienced professionals and new market participants. Our platform aims to deliver seamless access, empowering individuals keen on trading china with efficiency and reliability.

What fuels Exness’s notable success and strong footprint across Asia?

- Localized Support: We ensure our multilingual support teams are ready to assist traders in their native languages, understanding cultural preferences and specific queries unique to the region.

- Tailored Payment Solutions: A comprehensive array of local payment methods guarantees quick and convenient deposits and withdrawals, a critical convenience factor for traders throughout the continent.

- Competitive Trading Conditions: Our clients consistently benefit from tight spreads, lightning-fast execution, and a diverse range of trading instruments, all optimized to enhance their overall trading experience.

- Educational Resources: We empower traders with extensive educational materials and sharp market analysis, helping them refine their skills and make well-informed decisions, which is especially vital for those navigating the complexities of trading china.

Building a reputation as a trusted partner requires more than simply offering a trading platform; it demands profound market insight and consistent reliability. For traders actively seeking a dependable china broker, the focus often rests on transparency, unwavering security, and consistent service delivery. Exness is dedicated to upholding these fundamental principles, fostering long-term relationships built on mutual trust and proven performance.

Here’s a concise overview of key elements that position Exness strongly within the Asian market:

| Aspect | Exness’s Strategic Approach in Asia |

|---|---|

| Market Accessibility | Intuitive platforms and a broad selection of tradable instruments. |

| Security & Trust | Robust regulatory adherence and advanced data protection protocols. |

| Technological Edge | High-speed order execution and a consistently stable trading environment. |

We continuously refine our offerings, anticipating market shifts and evolving trader expectations. Our core mission remains clear: to ensure every trader, from emerging participants to seasoned experts, finds the precise support and cutting-edge tools they require to thrive in the exhilarating Asian financial markets. Explore how our dedication translates into a superior and more rewarding trading journey for you.

Is Exness Accessible for Traders in China?

Navigating the global forex market from within China presents unique challenges, leading many aspiring traders to question the accessibility of international brokers. A common query we encounter concerns Exness: Is Exness accessible for traders in China? Understanding the landscape for Exness China requires a look at both the broker’s operational approach and China’s distinct regulatory environment.

The regulatory framework governing financial services in China is notably stringent, especially concerning foreign exchange. The People’s Bank of China and other regulatory bodies impose strict capital controls and specific licensing requirements that significantly restrict foreign entities from directly offering “china forex” trading services to mainland residents. This environment makes it challenging for any international broker to establish a fully compliant and widely accessible presence.

Exness, as a globally recognized broker, operates with licenses from various reputable jurisdictions worldwide. While Exness maintains a strong international presence and serves clients in many countries, its direct accessibility for clients residing in mainland China faces considerable hurdles due to the aforementioned local regulations. This means that while the platform is robust and user-friendly for traders elsewhere, those actively “trading china” often encounter barriers.

Given these complexities, traders in China seeking to engage with the global forex market must exercise extreme caution and conduct thorough due diligence. Verifying the legitimacy and compliance of any broker claiming to serve clients in China is paramount. Focus on understanding the specific terms, conditions, and potential risks involved.

Key Considerations for Traders in China

For individuals interested in exploring trading opportunities, several factors come into play:

- Regulatory Landscape: China’s strict financial regulations make it difficult for international brokers to legally onboard clients residing within its borders. Any “china broker” operating without proper local authorization risks significant penalties.

- Capital Controls: Moving funds internationally for trading purposes can be complicated due to China’s capital outflow restrictions, impacting both deposits and withdrawals.

- Internet Access: The “Great Firewall” can restrict access to foreign websites and trading platforms, often requiring the use of Virtual Private Networks (VPNs), which might not always be reliable or legal.

- Payment Processing: International payment methods commonly used by brokers may not be readily available or easily processed for traders in China, adding another layer of complexity.

While the demand for global trading platforms like Exness remains high among those “trading china“, the current regulatory climate creates significant barriers. Always prioritize safety, security, and adherence to local laws when considering any financial activity. Making informed decisions protects your capital and ensures a more sustainable trading journey.

Direct Access vs. VPN Considerations for Exness

Navigating the world of online trading requires a stable and secure connection, especially when you operate from regions with unique internet landscapes. For traders looking to engage with Exness China, the choice between direct access and using a Virtual Private Network (VPN) is a crucial one. This decision directly impacts your trading experience and ability to react to market shifts effectively.

The Reality of Direct Access

While direct access to online platforms is always ideal, it is not always straightforward for everyone. For users in China, connectivity to international financial services can sometimes be inconsistent due to local network policies and infrastructure. This means your real-time trading china activities might face unexpected delays or disruptions, which is far from ideal in the fast-paced forex market. A less stable connection directly impacts your ability to execute trades swiftly and efficiently, potentially leading to missed opportunities or even losses.

How VPNs Can Help Your China Forex Trading

Many traders turn to VPNs to enhance their connectivity and ensure a smoother experience. A VPN creates a secure, encrypted tunnel between your device and the internet, routing your connection through servers in other locations. This can often provide a more stable and reliable path to international platforms like Exness, helping overcome potential geographical restrictions or network slowdowns. For anyone serious about china forex, a quality VPN can be a valuable tool, offering enhanced privacy and consistent access.

Weighing Your Options: Direct Access vs. VPN

Consider the core differences when planning your approach for Exness China:

| Feature | Direct Access | VPN Usage |

|---|---|---|

| Connection Stability | Can be inconsistent depending on regional network conditions. | Generally offers more stable and reliable international access. |

| Speed Potential | Potentially faster if unimpeded, but subject to local throttling. | Speed depends heavily on VPN server quality and location; can introduce latency. |

| Security | Standard internet security measures. | Enhanced encryption and privacy, masking your IP address. |

| Accessibility | May face restrictions to certain international trading sites. | Can often bypass geographical restrictions, broadening access. |

| Cost | Free (using your existing internet service). | Subscription cost for reliable, premium services. |

Choosing Your Approach for Exness Trading

When selecting a VPN for trading, prioritize services known for strong encryption, fast servers, and a strict no-logs policy. Latency is critical in forex trading, so test different server locations to find the optimal connection for your needs. Whether you are using Exness or any other global china broker, ensuring your access method aligns with your trading strategy and risk tolerance is paramount. Don’t compromise on stability and security; these are your cornerstones for successful online trading.

Ultimately, your decision on how to access Exness comes down to balancing convenience, reliability, and security. A robust internet connection, whether direct or via a premium VPN, ensures you can react to market movements without technical impediments. Make an informed choice to support your trading goals effectively and keep your trading china experience smooth.

Regulatory Landscape for Forex Trading in China

Navigating the world of foreign exchange in China presents a unique and often intricate challenge. Unlike many Western economies, the regulatory environment for retail forex trading in China is highly controlled. This means a distinct set of rules applies to any entity wishing to operate as a broker or for individuals engaging in trading activities.

The People’s Bank of China (PBOC) stands at the forefront, overseeing the nation’s monetary policy and the broader financial system. Alongside the PBOC, the China Banking and Insurance Regulatory Commission (CBIRC) holds significant sway, regulating banking and insurance institutions. The State Administration of Foreign Exchange (SAFE) specifically manages foreign exchange activities, capital flows, and the yuan’s convertibility. Their collective oversight shapes what is permissible in the realm of china forex.

Currently, domestic entities face strict prohibitions against offering over-the-counter (OTC) retail forex trading services to Chinese citizens. This effectively means there are no officially licensed local retail forex brokers operating within mainland China. Individuals engaging in trading china’s financial markets must understand these restrictions.

Despite these domestic limitations, Chinese residents often find avenues for forex trading through international brokers. These offshore platforms are regulated by authorities in other jurisdictions and operate outside the direct oversight of Chinese regulators. This scenario often sparks interest in platforms like Exness China, as traders seek global opportunities not readily available domestically.

For anyone considering forex endeavors, understanding this landscape is paramount. While the domestic environment is highly restrictive, the global market offers alternatives. However, traders must conduct thorough due diligence when choosing an international china broker, ensuring they select a reputable and well-regulated entity to safeguard their interests.

Here’s a quick overview of key regulatory impacts:

- Domestic Restriction: Chinese regulators do not issue licenses for local retail forex brokers.

- Capital Controls: Strict limits on capital outflow can impact fund transfers to and from international trading accounts.

- Information Access: Access to certain international trading platforms or financial news might face filtering.

- Offshore Reliance: Traders predominantly rely on international brokers regulated outside China.

People’s Republic of China Regulations on Online Trading

Navigating the complex landscape of online trading regulations in the People’s Republic of China demands precise understanding and careful adherence. The nation maintains a highly structured and evolving framework designed to control capital flows and protect its financial system. For anyone interested in trading China, or for international platforms, comprehending these rules is absolutely essential.

China’s regulatory bodies enforce strict oversight, particularly concerning foreign exchange transactions and capital movements. These efforts shape how individuals and businesses can engage with global markets, impacting access to various financial instruments.

Key Regulatory Authorities and Their Roles:

- People’s Bank of China (PBOC): Acts as the central bank, responsible for monetary policy, financial stability, and overall financial market supervision. They heavily influence cross-border capital flow policies.

- China Securities Regulatory Commission (CSRC): This commission oversees the securities and futures markets. They regulate domestic brokerages and ensure market integrity within the mainland.

- State Administration of Foreign Exchange (SAFE): Directly manages foreign exchange activities, playing a critical role in controlling inbound and outbound capital. SAFE’s regulations are paramount for any entity involved in china forex operations.

Foreign online trading platforms face significant hurdles operating directly within China’s mainland. The government has not widely permitted international brokers to solicit or provide services to domestic investors without specific, often hard-to-obtain, local licenses. This regulatory stance makes it challenging for a foreign entity like Exness China, for example, to establish a direct, onshore presence offering trading services to the general public.

Furthermore, China implements stringent capital controls, making it difficult for funds to move freely across borders for investment purposes. These controls aim to stabilize the local currency and prevent speculative outflows, directly influencing how Chinese residents can fund international trading accounts or withdraw profits.

The regulatory environment means individuals participating in trading China must be acutely aware of the rules. While specific regulations on individuals’ participation in overseas forex trading remain somewhat nuanced, the challenges for any foreign china broker seeking to operate openly and compliantly are clear. Staying informed about these regulations safeguards your financial interests and ensures you operate within legal boundaries.

Navigating the Grey Areas for International Brokers like Exness

The world of online trading thrives on global accessibility, yet some markets present unique complexities. For international brokers, serving clients in regions with evolving regulatory frameworks means constantly adapting. When we talk about a market like China, the landscape for forex trading is particularly nuanced. Brokers face significant hurdles, and understanding these “grey areas” is crucial for both providers and aspiring traders.The Regulatory Labyrinth for China Forex

China operates a tightly controlled financial system. While there is immense interest in trading, especially in the forex market, the official stance on foreign exchange speculation by individuals through international platforms remains largely undefined or restricted. This creates a challenging environment for any foreign entity aiming to serve “china forex” clients directly. A “china broker” typically operates under stringent domestic regulations, which often differ vastly from international standards. This regulatory ambiguity forms the core of the “grey area” for firms like Exness operating internationally.Key Challenges for Global Brokers in China

International brokers encounter several distinct obstacles when engaging with the Chinese market. These challenges demand innovative solutions and a careful approach to compliance and client service:- Legal Ambiguity: Direct advertising and solicitation of Chinese residents by foreign brokers face significant legal and operational uncertainties. Without clear guidelines, navigating local laws becomes a complex task.

- Payment Processing: Moving funds into and out of China presents substantial challenges. Capital controls and stringent banking regulations complicate deposits and withdrawals for international trading accounts.

- Website Accessibility: Access to international trading platforms can be inconsistent. Brokers must implement robust technical solutions to ensure reliable access for clients interested in “trading china.”

- Client Protection: Ensuring adequate legal recourse and protection for clients becomes complex without a clear regulatory framework governing foreign entities operating within this market.

How Brokers Adapt and Engage

Despite these significant hurdles, the demand for sophisticated trading tools and competitive conditions remains consistently high. International brokers often adapt their approach by:- Prioritizing robust technological infrastructure to maintain platform accessibility and performance.

- Focusing on comprehensive educational resources to empower traders with essential market knowledge and risk management strategies.

- Offering localized customer support to address specific client needs and cultural nuances effectively.

- Emphasizing compliance with stringent international financial standards, even where local regulations are unclear or evolving.

The Enduring Appeal for Traders

Why do traders in China continue to seek international brokers? They often look for access to a wider range of financial instruments, advanced trading platforms, tighter spreads, and different leverage options not always available through domestic channels. The pursuit of sophisticated trading experiences and global market access drives many to explore these international avenues. They seek a professional environment that prioritizes cutting-edge technology and client empowerment. Navigating the Chinese market is a masterclass in strategic flexibility for international brokers. It demands a deep understanding of evolving regulations, technological prowess, and an unwavering commitment to client service. As the market continues to mature, so too will the strategies employed by leading global brokers to responsibly and effectively engage with this dynamic landscape.Key Features and Advantages of Exness for Chinese Clients

Exness stands out as a premier china broker, meticulously designed to meet the unique demands and preferences of Chinese clients. Our commitment to empowering your trading journey shines through a suite of robust features and distinct advantages, ensuring a seamless and highly effective experience.

Unparalleled Localized Support and Accessibility

We understand that effective communication and accessible services form the backbone of a successful trading relationship. Exness China operations prioritize your convenience and peace of mind.

- Dedicated Mandarin-Speaking Support: Access expert customer service around the clock, with professionals fluent in Mandarin ready to assist you promptly with any inquiries.

- Convenient Local Payment Solutions: Manage your funds effortlessly with a range of deposit and withdrawal methods popular in China, ensuring quick and secure transactions tailored to your needs.

- Intuitive Platform Experience: Navigate our user-friendly trading platforms, including MT4 and MT5, with interfaces optimized for clarity and ease of use for traders across China.

Competitive Trading Conditions for the China Forex Market

When you participate in the fast-paced china forex market, every pip and second counts. Exness delivers superior trading conditions engineered to maximize your potential.

- Razor-Thin Spreads: Benefit from some of the industry’s tightest spreads on major currency pairs, metals, energies, and indices, significantly reducing your trading costs.

- Lightning-Fast Execution: Experience ultra-low latency trade execution, ensuring your orders are filled precisely and without delay, even during volatile market periods.

- Flexible Leverage Options: Tailor your trading strategy with a variety of flexible leverage settings, empowering you to manage risk and potential returns effectively.

- Transparent Pricing: Trade with confidence, knowing there are no hidden commissions or unexpected fees. We pride ourselves on clear, straightforward pricing.

Robust Security and Reliability

Your security and the safety of your funds are paramount. As a leading china broker, Exness implements stringent measures to protect your investments and provide a stable trading environment.

| Security Aspect | Exness’s Commitment |

|---|---|

| Client Fund Segregation | Client funds are held in segregated accounts, entirely separate from company operating capital. |

| Regulatory Compliance | Adherence to international financial regulations provides a trustworthy trading environment. |

| Advanced Data Encryption | Utilizing state-of-the-art encryption technologies to safeguard your personal and financial data. |

Choosing Exness means opting for a partner dedicated to your trading success and security in the demanding world of online trading. We invite you to experience the difference a truly client-focused china broker can make.

Deposit and Withdrawal Options for Exness China Users

Navigating the financial markets requires not only sharp strategies but also seamless access to your funds. For traders in China, understanding the deposit and withdrawal options is crucial. Exness China prioritizes efficient and secure transaction methods, ensuring you can manage your capital with ease and confidence.

Funding Your Trading Account with Ease

Funding your trading account should always be straightforward. Exness provides a range of deposit solutions tailored for our users. You can quickly add capital and get right into the action. We focus on methods that are both convenient and secure for the China forex market.

- Local Bank Transfers: A familiar and trusted route. You can transfer funds directly from your local bank account, providing a reliable and secure option.

- Popular E-wallets: Utilize widely recognized electronic payment systems for fast processing. These methods offer instant or near-instant deposits, getting you into the market without delay.

- Online Payment Solutions: Access diverse choices for flexibility. These secure platforms offer various ways to top up your account, catering to different preferences.

Seamless Withdrawals: Accessing Your Profits

When it is time to access your profits, you deserve a process that is just as smooth and reliable. Exness China ensures your withdrawals are processed swiftly and securely. We offer trusted options, making sure your hard-earned gains are always within reach.

- Bank Transfers: Withdraw your funds directly to your local bank account. This provides a secure way to receive larger amounts.

- E-wallet Withdrawals: Experience quick access to your funds. E-wallet options typically offer faster processing times, ideal when you need your money promptly.

- Other Online Payment Systems: Benefit from flexible choices for diverse needs, ensuring you have multiple avenues to retrieve your capital.

Key Considerations: Speed, Security, and Fees

Understanding the finer details of transactions helps you plan effectively. Processing times for both deposits and withdrawals vary based on the method you choose. Most e-wallet transactions are instant or near-instant, while bank transfers might take a few business days. Exness strives for the fastest possible execution across all methods, supporting your trading China journey.

| Method Category | Typical Deposit Time | Typical Withdrawal Time |

|---|---|---|

| E-wallets & Online Systems | Instant to a few minutes | Instant to a few hours |

| Bank Transfers (Local) | 1-3 business days | 1-7 business days |

Security remains paramount. All transactions are protected with advanced encryption technologies. We adhere to strict regulatory standards, providing a secure environment for every China broker client. While Exness generally offers zero commission on deposits and withdrawals, it is always wise to check if your chosen payment provider applies any independent charges.

Popular Local Payment Methods and E-wallets

For traders engaging with platforms like Exness China, a seamless funding experience is paramount. Accessing reliable and convenient local payment methods can significantly enhance your trading journey in China. We understand the importance of secure and efficient transactions, especially when navigating the China forex market.

China’s digital payment landscape is largely dominated by powerful e-wallets and robust online banking systems. These platforms offer unparalleled convenience and speed, making them top choices for many involved in trading in China:

- Alipay: A veteran in the digital payment space, Alipay remains a go-to for countless users. Its robust features and widespread acceptance make it a highly favored method for funding trading accounts quickly and securely.

- WeChat Pay: Integrated deeply into daily life, WeChat Pay provides another incredibly convenient option. Its ease of use within the WeChat ecosystem makes it a popular choice for quick deposits and withdrawals.

- Direct Online Banking Transfers: Beyond e-wallets, direct online banking transfers offer another reliable avenue for managing your funds. Most major banks support these transactions, providing a direct link between your personal bank account and your trading platform. This method is often preferred for larger sums and offers a familiar, secure process for many who choose a China broker for their trading needs.

Choosing the right payment method streamlines your experience, allowing you to focus on market analysis and strategy rather than logistical hurdles. Our goal is to ensure you have the easiest possible access to your funds, empowering your trading endeavors.

Multilingual Customer Support for Chinese Traders

Navigating the dynamic world of online trading demands clear communication and reliable assistance. For traders in the Chinese market, linguistic barriers can turn a simple query into a major headache, hindering timely decisions and overall trading confidence. That’s why top-tier customer support, delivered in your native language, is not just a luxury—it’s essential.

Exness understands these unique needs perfectly. When you engage with Exness China, you gain access to a dedicated multilingual support team, ready to assist you in Mandarin and other relevant dialects. This commitment ensures you always receive precise, understandable answers, eliminating potential misunderstandings that can impact your trading journey.

Why Native Language Support Matters

Having support in your mother tongue makes a significant difference, especially in the fast-paced environment of `china forex` trading. Here’s why it’s a game-changer:

- Instant Clarity: No more struggling with translations or second-guessing technical terms. Get straightforward explanations right away.

- Enhanced Trust: Speak directly with professionals who understand your specific context and concerns, fostering a stronger sense of reliability.

- Faster Resolutions: Quickly resolve any account, platform, or transaction issues without linguistic hurdles slowing you down.

- Better `Trading China` Experience: Focus on your strategies, knowing that expert help is just a message or call away, ready to assist with any platform functionality or policy question.

Seamless Support Channels

As a leading `china broker`, Exness provides multiple convenient ways to connect with our Chinese-speaking support specialists. We ensure accessibility and prompt responses across various platforms to suit your preference:

| Channel | Availability | Benefits |

|---|---|---|

| Live Chat | 24/7 | Instant responses, quick issue resolution. |

| Email Support | Within 24 hours | Detailed queries, documentation sharing. |

| Phone Support | Business Hours | Personalized conversation, complex problem-solving. |

Choose the method that best fits your immediate needs and communicate effectively with our knowledgeable team. We empower you to trade with peace of mind, knowing that a professional, culturally aware support network always backs you up. Experience the difference dedicated local language support makes for your `Exness China` trading today.

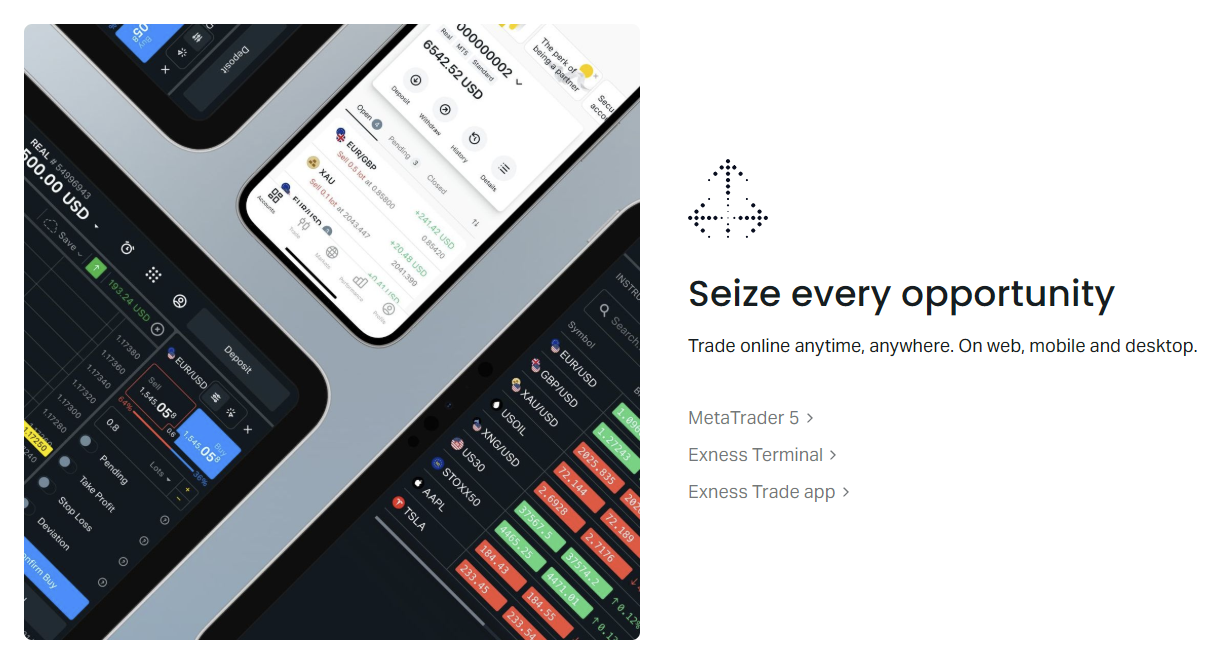

Trading Platforms Available to Exness China Clients

For Exness China clients, selecting the right trading platform is crucial for success. Your platform is your gateway to the global financial markets, offering the tools and speed you need to make informed decisions. We understand this deeply, and that’s why we provide access to a suite of robust, user-friendly platforms designed to meet the diverse needs of traders engaging in trading China.

MetaTrader 4 (MT4)

MetaTrader 4 stands as an industry benchmark, renowned for its reliability and intuitive interface. Millions of traders worldwide trust MT4 for its powerful charting capabilities, extensive range of technical indicators, and support for automated trading through Expert Advisors (EAs). This platform delivers a stable environment, making it an excellent choice for Exness China clients, whether you are new to forex or an experienced market participant. It provides all the essentials you need to navigate the dynamic china forex market with confidence.

MetaTrader 5 (MT5)

Building on the strengths of its predecessor, MetaTrader 5 offers an expanded feature set for those who demand more advanced analytical tools and trading options. MT5 provides additional timeframes, more graphical objects, and an economic calendar integrated directly into the platform. You also gain access to the depth of market (DOM) functionality, giving you a clearer view of market liquidity. For an Exness China broker client seeking to explore a wider range of financial instruments and employ more sophisticated strategies, MT5 is an ideal choice.

Exness Terminal (Web Terminal)

Our custom-built Exness Terminal delivers powerful trading directly through your web browser. This means no downloads or installations – just instant access to your trading account from any device with an internet connection. The Exness Terminal features a clean, intuitive interface, real-time quotes, and advanced charting tools, all designed for seamless performance. It offers incredible flexibility, allowing Exness China traders to manage positions and react to market movements anytime, anywhere, without compromising on functionality.

Mobile Trading Applications

The fast-paced world of china forex demands flexibility. Our dedicated mobile trading applications for iOS and Android devices ensure you never miss an opportunity. These apps put the full power of the market in your pocket, offering real-time quotes, advanced charting, and comprehensive account management features. Monitor your trades, open new positions, and manage your risk all from the convenience of your smartphone or tablet. For an Exness China trader on the go, these mobile solutions are indispensable tools.

Here’s a quick overview of what each platform brings to the table:

| Platform | Key Benefit | Ideal For |

|---|---|---|

| MetaTrader 4 | Reliability & EAs | Standard forex trading & automation |

| MetaTrader 5 | Advanced tools & instruments | Sophisticated traders & diverse markets |

| Exness Terminal | Browser-based convenience | Trading from any device without installation |

| Mobile Apps | On-the-go access | Managing trades remotely & quick market access |

Each platform offers unique advantages. Explore them and discover the perfect fit for your individual trading style and goals as an Exness China client. We empower you with the tools to succeed.

Account Types and Tailored Trading Conditions

Choosing the right account is paramount for your trading journey. We recognize that every trader possesses unique requirements, especially those actively engaged in the dynamic landscape of trading china. That’s why we meticulously crafted a diverse array of account types, each designed to align with various experience levels and strategic approaches. Whether you are just beginning your venture into the financial markets or you are an experienced professional, you will discover an account that perfectly complements your trading style. Our Standard Account offers a straightforward gateway to the markets, ideal for those seeking simplicity and ease of use. For seasoned traders who demand more from their platform, our Professional Accounts deliver advanced features and tighter spreads, specifically tailored for active participants in china forex markets. We understand the unique demands of the local market. Our commitment to providing tailored trading conditions reflects this insight, creating an optimized environment for all our clients, including those specifically trading with Exness China. This dedication translates into carefully considered leverage options, exceptionally competitive spreads, and consistently reliable execution speeds. We aim to empower your decisions, ensuring you have the tools to thrive.Key Features of Our Tailored Conditions:

- Flexible Leverage: Adjust your leverage to match your precise risk tolerance and strategic needs.

- Low, Stable Spreads: Benefit from some of the industry’s most competitive spreads, significantly reducing your overall trading costs.

- Ultra-Fast Execution: Experience near-instant order execution, a critical advantage in fast-moving and volatile market conditions.

- Extensive Instrument Range: Access a broad spectrum of trading instruments, diversifying your portfolio beyond traditional forex pairs.

- Dedicated Local Support: Receive prompt, knowledgeable, and localized customer support precisely when you need it most – a defining characteristic for any top-tier china broker.

Leverage, Margin, and Trading Limits

Understanding leverage, margin, and trading limits is fundamental for any trader navigating the financial markets, especially within the dynamic environment of Exness China. These three concepts are not just technical terms; they are the pillars of effective risk management and directly influence your trading potential and strategy. Mastering them allows you to trade with confidence and make informed decisions on your journey.At its core, leverage is a powerful tool. It allows traders to control a larger position in the market with a relatively small amount of capital. Think of it as a financial booster for your buying power. For instance, with 1:500 leverage, a $100 investment can control a position worth $50,000.

While the allure of amplified profits is strong, it’s crucial to approach leverage with a clear understanding of its implications. Exness China offers flexible leverage options, catering to various trading styles and risk appetites within the china forex market.

Here’s a quick look at the duality of leverage:

- Potential for Amplified Gains: Even small price movements can lead to significant profits.

- Increased Market Exposure: You can open larger positions than your actual capital would normally allow.

- Enhanced Capital Efficiency: Your capital is not tied up entirely, freeing up funds for other opportunities or diversification.

- Potential for Amplified Losses: Just as gains can be magnified, so too can losses. A small adverse price move can quickly deplete your account.

- Higher Risk Profile: Greater exposure naturally means greater risk if not managed properly.

- Increased Margin Requirements: Higher leverage often demands stricter attention to your available margin.

Margin is the actual capital you need to deposit and hold in your trading account to open and maintain a leveraged position. It acts as collateral for your trades. When you use leverage, only a fraction of the total trade value is required as margin. For example, if you open a $10,000 position with 1:100 leverage, your margin requirement would be $100.

Keeping a close eye on your margin level is paramount. If your open positions move against you and your equity falls below a certain percentage of the required margin, you might face a ‘margin call.’ This is an alert from your china broker, like Exness, requesting you to deposit more funds to cover your open positions or to close some trades to reduce your margin requirement. Failing to meet a margin call can result in your positions being automatically closed by the broker to prevent further losses.

“Understanding margin isn’t just about avoiding a margin call; it’s about safeguarding your capital and maintaining control over your trading journey.”

Trading limits are specific restrictions imposed on your trading activity. These are in place for various reasons, including risk management, maintaining market stability, and ensuring fair trading conditions for all participants, particularly for those engaging in trading China’s dynamic markets. Limits can vary based on the specific instrument, account type, or prevailing market conditions.

Common types of trading limits you might encounter:

| Limit Type | Description | Purpose |

|---|---|---|

| Position Limits | The maximum size of a single open trade or total open trades you can have for a particular instrument. | Prevents individual traders from unduly influencing market prices and manages the broker’s overall exposure. |

| Order Limits | Restrictions on the number of pending orders (e.g., limit, stop orders) you can place at any one time. | Manages system load and ensures efficient order processing. |

| Volume Limits | A maximum amount of volume you can trade within a specific period or for a single transaction. | Similar to position limits, it aids in market stability and risk management for both trader and broker. |

These limits are a protective measure, designed to help traders manage their risk exposure and ensure that the market remains orderly. A reputable china broker will always transparently communicate these limits. Familiarizing yourself with these aspects before you start trading can significantly enhance your strategic planning and execution.

Spreads, Commissions, and Trading Costs

Diving into the world of online trading demands a sharp understanding of the costs involved. For anyone engaged in china forex, deciphering the true cost of each trade is paramount. These aren’t hidden fees; instead, they are the operational expenses that shape your profitability. A clear picture of spreads, commissions, and other trading costs empowers you to make smarter decisions and optimize your strategy.

Understanding Spreads: Your First Cost

The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It’s essentially the cost of executing a trade. Spreads can vary widely, influenced by market volatility, liquidity, and the specific broker. Exness China, like many leading platforms, often provides competitive spreads designed to benefit traders.

Here’s how different spread types impact your trading:

- Variable Spreads: These fluctuate based on market conditions. During high volatility, spreads widen, and during calm periods, they tighten. This offers potentially lower costs in stable markets but higher costs during news events.

- Fixed Spreads: As the name suggests, these remain constant regardless of market volatility. They offer predictability, which is excellent for cost planning, especially during choppy market conditions. However, they might be slightly wider than the tightest variable spreads during quiet periods.

When you are actively trading china markets, every pip and penny counts towards your bottom line. Choosing a broker with consistently tight and transparent spreads can significantly enhance your trading edge.

Unpacking Commissions

While spreads are almost universally applied, commissions represent another layer of cost, primarily associated with certain account types or trading instruments. Often, brokers offering raw or ultra-low spreads compensate by charging a fixed commission per lot traded. This model is typical for ECN (Electronic Communication Network) accounts, which directly connect traders to liquidity providers.

A reputable china broker will clearly outline its commission structure. It’s vital to calculate how commissions, when combined with spreads, affect your total transaction cost. Sometimes, an account with a slightly wider spread but no commission might be cheaper than one with a raw spread plus a significant commission, depending on your trading volume and strategy.

Other Potential Trading Costs

Beyond spreads and commissions, several other factors can influence your overall trading expenses. Being aware of these ensures no surprises:

| Cost Type | Description |

|---|---|

| Swap Fees (Overnight Fees) | Charges or credits applied for holding positions open overnight. These depend on the interest rate differential between the two currencies in a pair and can be positive or negative. |

| Deposit/Withdrawal Fees | While many brokers offer free deposits, some payment methods or withdrawal options might incur small charges. Always check the specific terms of your preferred method. |

| Inactivity Fees | Some brokers charge a small fee if an account remains dormant for an extended period. This encourages active trading or account closure if not in use. |

Understanding the transparent fee structure offered by Exness China is crucial for maximizing your trading potential. Before committing, thoroughly review the terms and conditions related to all trading costs. This proactive approach sets a solid foundation for your trading journey.

Security, Trust, and Fund Protection at Exness

When you engage in financial markets, especially with online brokers, paramount concerns revolve around security, trust, and the ironclad protection of your hard-earned capital. At Exness, these aren’t just buzzwords; they are foundational pillars guiding every aspect of our operations, particularly for our valued clients engaging in trading China’s dynamic markets.

We understand the importance of peace of mind. That’s why we dedicate substantial resources to ensuring a secure and transparent trading environment. Our commitment extends globally, providing robust safeguards that make Exness China a trusted name for participants in the china forex landscape.

Upholding Stringent Regulatory Standards: A strong regulatory framework is the cornerstone of trust. Exness operates under strict oversight from leading financial authorities around the world. These licenses demand unwavering adherence to capital requirements, operational transparency, and rigorous client protection protocols. This multi-jurisdictional regulation offers a comprehensive layer of security, assuring clients that their interests remain protected under stringent rules designed for financial stability and integrity.

Segregation of Client Funds: Your Capital, Clearly Defined: One of the most critical security measures is the segregation of client funds. We maintain client accounts entirely separate from our company’s operational funds. This means:

- Your trading capital is held in distinct bank accounts.

- It remains untouched by any company expenses or liabilities.

- In the unlikely event of company insolvency, your funds are protected and inaccessible to creditors.

This fundamental practice ensures your investment is always yours, providing a clear distinction and safeguarding your financial security.

Advanced Data Encryption and Privacy: Protecting your personal and financial data is non-negotiable. We employ state-of-the-art encryption technologies to secure all communications and transactions between your device and our servers. Our data security protocols are continually updated to counter evolving cyber threats. We implement robust firewalls and adhere to strict privacy policies, ensuring your confidential information remains private and protected from unauthorized access.

Operational Transparency and Fair Execution: Transparency builds trust. Exness commits to clear pricing, fair execution, and accurate reporting. Our trading models are designed for reliability and minimal slippage, ensuring that your trades are executed precisely and efficiently. We provide detailed transaction histories and statements, empowering you with a complete overview of your trading activity. This commitment to fairness is crucial for traders engaging with Exness China and across the globe.

Building Trust as a Reliable China Broker: Our long-standing presence and global reputation speak volumes. We’ve earned the trust of millions of traders worldwide by consistently prioritizing security and client satisfaction. As a dedicated china broker, we understand the specific needs of the market and strive to exceed expectations through dependable service and unparalleled fund protection. This focus ensures a secure environment for everyone involved in trading China’s markets.

Our commitment to security, trust, and fund protection is unwavering. It’s how we empower you to focus on your trading strategies with complete confidence, knowing your capital and data are in safe hands.

Segregated Client Accounts Policy

Your financial security sits at the core of trustworthy trading. That’s why the Segregated Client Accounts Policy stands as a cornerstone for any reputable broker. This critical safeguard ensures your invested funds remain entirely separate from a broker’s operational capital. For those engaging in trading China, understanding this policy offers immense peace of mind.

This policy means we place all client funds into accounts distinct from our company’s business funds. Imagine it as a dedicated vault for your money, inaccessible for our operational expenses. This proactive approach delivers several key benefits:

- Enhanced Security: Your capital is protected from any potential financial difficulties our company might face.

- Clear Separation: We maintain a transparent distinction between your investment and our company assets.

- Unwavering Accessibility: Your funds remain yours, ready for your trading decisions or withdrawals.

As a leading china forex broker, Exness China takes this commitment seriously. We meticulously manage all client funds in dedicated, separate bank accounts. This prevents any commingling of your capital with our own business assets. Your deposits are truly yours, accessible and secure, reflecting our unwavering dedication to client safety.

| Policy Aspect | Benefit to You as a Trader |

|---|---|

| Client Funds Segregation | Your investment capital is kept separate from company operational funds. |

| Protection from Insolvency | Provides a layer of security against the unlikely event of company financial distress. |

| Increased Transparency | Offers clear accountability for your deposited funds. |

This robust Segregated Client Accounts Policy is more than just a regulatory checkbox; it’s a fundamental promise to you. When you choose Exness China, you choose a partner prioritizing the absolute safety of your capital, allowing you to focus on your trading strategies with confidence. Experience the difference a truly secure trading environment makes.

Step-by-Step Guide to Opening an Exness Account from China

Ready to explore the dynamic global financial markets right from China? Opening an Exness account is a straightforward path to accessing diverse trading opportunities. This step-by-step guide cuts through the complexity, ensuring a smooth start to your journey with Exness China. Many traders seek a reliable partner, and this guide simplifies the process for those interested in trading China’s vibrant market.

1. Prepare Your Documents

Before you begin the registration process, gather a few essential documents. This preparation makes your signup quick and efficient, helping you move closer to engaging in china forex activities.

- Valid Identification: A clear scan or photo of your passport or national ID card. Ensure all details are visible and legible.

- Proof of Residency: A recent utility bill, bank statement, or government-issued residency certificate. This document must show your full name and current address, typically issued within the last six months.

- Active Communication: An accessible email address and a valid phone number for account verification and updates.

2. Start Your Registration Online

Now, let’s dive into the core steps of creating your Exness account. This part is intuitive and designed for ease of use, regardless of your experience with a china broker.

- Visit the Exness Website: Navigate to the official Exness website. Look for the “Open Account” or “Register” button, usually prominently displayed on the homepage.

- Enter Basic Information: Provide your country of residence (China), your email address, and create a strong, secure password. Always read and confirm your agreement to the terms and conditions.

- Verify Your Email/Phone: Exness sends a verification code to your registered email or phone number. Enter this code on the website to proceed to the next stage.

- Choose Your Account Type: Select an account that aligns with your trading style. Exness offers various options like Standard, Standard Cent, Pro, Zero, and Raw Spread. Each caters to different needs and experience levels.

- Select Trading Platform: Decide whether you prefer MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Both are industry-leading platforms, offering powerful tools for analysis and execution.

3. Complete Account Verification (KYC)

Account verification is a critical step. It ensures the security of your funds and complies with international regulatory standards. This process protects your account and authenticates your identity.

- Upload ID Document: Submit the clear image of your chosen identification document. Ensure the name, photo, date of birth, and expiry date are perfectly readable.

- Submit Proof of Address: Upload your residency document. The details must match the information provided during registration.

- Wait for Approval: The Exness verification team reviews your documents promptly. You receive an email notification once your account status changes to verified. This usually takes a short time.

4. Fund Your Exness Account

With your account successfully verified, the next step is to deposit funds. Exness offers a variety of convenient payment methods to facilitate your trading journey from China.

| Deposit Method | Speed | Ease of Use |

|---|---|---|

| Bank Transfer | Typically 1-3 business days | Moderate |

| E-wallets (e.g., Neteller, Skrill) | Instant or within minutes | High |

| Cryptocurrencies (e.g., USDT, BTC) | Varies by network, usually fast | Moderate to High |

Choose your preferred method from the client area, enter the desired deposit amount, and follow the simple on-screen instructions to complete your transaction. You are almost ready for trading China’s dynamic markets!

5. Start Trading

Your account is funded, verified, and ready to go! This is where your trading journey truly begins. Access your chosen platform and explore the vast world of financial instruments.

Log in to your MT4 or MT5 platform using your account credentials. Browse available assets, analyze market movements, and place your first trade. Remember, continuous learning and strategic planning are key to success when trading China’s unique market conditions.

“Navigating the financial markets requires both knowledge and a robust platform. Exness provides the tools; your strategy drives success.”

Overcoming Potential Connectivity Challenges

A stable and reliable internet connection is paramount for successful online trading, especially for those engaging in the dynamic world of Exness China. Connectivity challenges, while often outside our direct control, can disrupt your trading flow and impact crucial decisions. We understand these potential hurdles and want to equip you with the knowledge to maintain an optimal trading environment.

Why Connectivity Matters for China Forex Trading

Imagine being in the middle of a critical trade, only for your connection to falter. In the fast-paced realm of china forex, even a momentary disruption can lead to missed opportunities or unexpected outcomes. Low latency and consistent uptime are not just preferences; they are necessities for executing trades accurately and receiving real-time market data.

“In trading, every second counts. A robust connection is your direct link to market movements.”

Practical Steps to Enhance Your Trading China Connection

While some factors are external, many proactive steps can significantly improve your personal internet stability. Take control of your trading experience with these actionable tips:

- Choose a Reliable Internet Service Provider (ISP): Opt for an ISP known for stability and speed in your region. Research local options and read user reviews to make an informed choice.

- Utilize a Wired Connection: Whenever possible, connect your device directly to your router using an Ethernet cable. Wired connections offer superior stability and speed compared to Wi-Fi, reducing latency and signal drops.

- Optimize Your Wi-Fi Environment: If you must use Wi-Fi, ensure your router is in a central location, free from obstructions. Minimize interference from other electronic devices.

- Close Unnecessary Applications: Background applications and browser tabs can consume significant bandwidth. Close anything not directly related to your trading china activities to free up resources.

- Monitor Your Connection: Regularly check your internet speed and stability using online tools. This helps you identify potential issues before they impact your trades.

- Consider a Backup Plan: Have a secondary internet source ready, such as a mobile hotspot, in case your primary connection experiences an outage.

How a Leading China Broker Addresses Stability

Even with excellent personal connectivity, the infrastructure of your chosen broker plays a vital role. As a preferred choice for many, we prioritize system robustness and global server distribution to ensure seamless access. We invest heavily in our technical backbone, aiming to provide a resilient platform that can handle varying network conditions across different regions. Our goal is to minimize server-side latency and ensure that your commands reach the market swiftly, reinforcing our commitment as a reliable china broker option for your trading journey.

By combining your efforts to optimize personal connectivity with our robust platform, you create the strongest possible foundation for your trading success.

Exness China: Comparison with Local Brokerage Services

Navigating the landscape for trading in China presents unique choices for investors. You might weigh options between international powerhouses like Exness China and established local brokerage services. Understanding these differences helps you make an informed decision for your China forex journey.

Here is a direct look at how Exness China compares with typical local alternatives:

| Aspect | Exness China | Local China Brokerage Services |

|---|---|---|

| Regulatory Oversight | Regulated by multiple, reputable international authorities, offering broad investor protection. | Primarily adheres to domestic regulations, focusing on local market compliance and operations. |

| Trading Platforms | Provides access to industry-standard platforms like MetaTrader 4/5, known for advanced tools and customization. | Often utilizes proprietary platforms, which can vary in features, ease of use, and analytical capabilities. |

| Asset Availability | Offers a wide array of instruments including forex pairs, cryptocurrencies, stocks, indices, and commodities. | May feature a more concentrated selection, sometimes emphasizing instruments relevant to the local market. |

| Customer Support | Provides multilingual support around the clock, with dedicated teams often understanding regional nuances. | Typically offers support primarily in Mandarin, usually limited to local business hours. |

| Funding Options | Supports diverse international and localized payment methods for seamless deposits and withdrawals. | Integrates strongly with local Chinese banking and payment systems, ensuring familiar transaction processes. |

Many traders exploring the China forex market find Exness China particularly compelling due to several distinct advantages:

- Global Market Access: Gain entry to extensive global markets with deep liquidity, potentially leading to tighter spreads.

- Advanced Technology: Benefit from cutting-edge trading platforms, robust mobile applications, and sophisticated analytical tools.

- Flexible Conditions: Access competitive pricing, varied account types, and adjustable leverage options catering to different trading strategies.

- Strong Security: International regulation and advanced data encryption practices contribute to a secure trading environment.

Local china broker services, on the other hand, possess their own unique strengths. They often provide deep insights into the domestic market and navigate local payment systems with unmatched efficiency. Their offerings sometimes cater specifically to local investor preferences and regulatory structures.

“Making an informed choice means aligning a broker’s offerings with your individual trading goals and comfort level. Consider which features matter most for your trading journey in China.”

Ultimately, your decision hinges on your priorities. Do you seek international diversity and advanced tools, or do you prefer highly localized services and domestic market focus? Evaluate each aspect carefully.

The Future of Exness Operations in the Chinese Market

The dynamic financial landscape in China presents both incredible opportunities and unique challenges for global trading platforms. For Exness, understanding and adapting to this intricate market is key to sustainable growth. As a leading retail broker, our focus remains on providing superior trading conditions and robust support, a commitment that naturally extends to our clients engaging in `trading china`. We believe the future for Exness operations in the Chinese market is bright, built on strategic vision and a deep understanding of local nuances.Navigating the regulatory environment is paramount for any global financial institution eyeing the vast potential of `china forex`. This involves continuous monitoring and proactive compliance to ensure a secure and trustworthy trading experience. Our approach centers on transparent operations, respecting the local legal framework while innovating to meet the evolving needs of traders. This careful balance will define how Exness China expands its footprint and solidifies its reputation.

Key Pillars for Success in China:

- Localization of Services: Offering platforms and support tailored to local languages and cultural preferences is essential. This includes payment methods and customer service hours that align with the region.

- Technological Adaptation: Ensuring our trading infrastructure is optimized for performance within China, providing fast execution and reliable access to financial markets.

- Education and Empowerment: Providing educational resources specifically designed for the Chinese trading community helps empower traders with the knowledge they need to navigate the markets confidently.

The role of technology cannot be overstated. From advanced trading platforms to efficient mobile applications, ensuring seamless access and user experience is critical. As a prominent `china broker`, Exness continually invests in cutting-edge solutions that cater to the high demands of active traders. This commitment to innovation is a cornerstone of our strategy, aiming to deliver an unparalleled trading environment.

“The Chinese market is characterized by rapid innovation and a highly engaged trading community. Our future success hinges on not just meeting but exceeding expectations for service, security, and technological prowess.”

Opportunities and Considerations for Exness China:

| Opportunity | Consideration |

|---|---|

| Growing investor base interested in diverse financial instruments. | Evolving local market regulations and compliance requirements. |

| High adoption rate of mobile technology for trading. | Ensuring robust data security and privacy measures. |

| Demand for high-quality educational resources. | Competition from both international and local brokers. |

Our long-term vision for `Exness China` involves deepening relationships with local communities and stakeholders. By fostering trust and providing exceptional service, we aim to be the preferred choice for traders seeking reliable and innovative solutions in the region. We are excited about what the future holds and invite you to join us on this journey. Experience the difference a dedicated `china broker` makes.

Frequently Asked Questions

Is Exness directly accessible for traders residing in mainland China?

Due to China’s stringent financial regulations and capital controls, direct accessibility for international brokers like Exness to clients residing in mainland China faces considerable hurdles. Traders often need to navigate a complex regulatory environment.

What kind of localized support does Exness offer for Chinese traders?

Exness provides dedicated Mandarin-speaking customer support available around the clock, along with convenient local payment solutions for deposits and withdrawals, and intuitive trading platforms optimized for clarity and ease of use.

What trading platforms are available for Exness China clients?

Exness China clients can access industry-standard platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the custom-built Exness Terminal (web terminal), and dedicated mobile trading applications for iOS and Android devices.

How does Exness ensure the security of client funds?

Exness upholds stringent regulatory standards, segregates client funds in separate bank accounts from company operational capital, and employs advanced data encryption technologies to protect personal and financial information.

What are the primary payment methods for Exness China users?

Exness China users can utilize local bank transfers, popular e-wallets like Alipay and WeChat Pay, and various other online payment solutions for convenient and secure deposits and withdrawals.