Embarking on your trading journey requires a reliable and convenient way to manage your funds. Understanding the various Exness deposit methods is crucial for a smooth start and uninterrupted trading experience. Accessibility and flexibility are paramount, which is why Exness offers a comprehensive range of payment options designed to meet the diverse needs of traders worldwide. Efficient ways to fund your account ensure you can seize market opportunities without delay. The platform prides itself on providing robust and secure deposit methods, focusing on speed and user-friendliness. From traditional banking solutions to modern e-wallets, the array of Exness deposits ensures there is an option that works perfectly for you.

This approach brings a new level of convenience and speed to managing your trading capital.

Most exness deposits boast instant processing, meaning your funds reflect in your trading account almost immediately, allowing you to react swiftly to market movements.

Here’s a quick overview of key features you can expect from your Exness deposit methods:

| Feature | Description |

| Instant Processing | Many deposit methods process funds in seconds. |

| Zero Commission | Exness typically covers transaction fees for deposits. |

| High Security | Advanced encryption and fraud prevention measures protect your funds. |

| 24/7 Availability | Fund your account anytime, day or night. |

Ready to experience seamless funding? Exploring the range of available Exness deposit methods is your first step towards a more empowered trading journey. Pick the method that best suits your needs, fund your account with confidence, and start trading today!

- Understanding Exness Deposit Methods

- Explore Your Payment Options

- Key Considerations for Your Deposits

- How to Fund Your Account

- Overview of Available Exness Deposit Options

- Bank Transfer Methods for Exness Accounts

- Why Bank Transfers Stand Out

- Understanding the Types of Bank Transfers

- How to Make Your Exness Deposit via Bank Transfer

- Important Considerations for Bank Transfers

- Local and International Wire Transfers

- Credit and Debit Card Deposits with Exness

- How to Fund Your Account with Cards

- Key Details for Card Deposits

- Pros and Cons of Using Cards for Deposits

- Popular E-Wallet Solutions

- Skrill and Neteller

- Other E-Wallets like Perfect Money

- Why choose e-wallets for your Exness deposits?

- Cryptocurrency Deposits on Exness

- Using BTC, USDT, and Other Cryptos

- Minimum and Maximum Deposit Limits

- Minimum Deposit Requirements

- Maximum Deposit Thresholds

- How to Check Your Specific Limits

- Understanding Deposit Processing Times

- What Influences Deposit Speed?

- Exness’s Commitment to Swift Deposits

- Typical Processing Times by Deposit Method

- Tips for Faster Deposit Processing

- Exness Deposit Fees Explained

- Step-by-Step Guide: How to Deposit Funds

- Security Measures for Your Exness Deposits

- Advanced Encryption and Data Protection

- Regulatory Compliance and Fund Segregation

- Personalized Account Protections

- Secure Payment Options and Vetted Partners

- What to Do If Your Deposit Has Issues (Troubleshooting)

- Choosing the Right Exness Deposit Method

- Exness Deposit Methods: Frequently Asked Questions

- What are the primary Exness Deposit Methods available?

- How do I fund my account with Exness?

- Are there any fees associated with Exness deposits?

- What are the typical processing times for Exness Deposit Methods?

- What is the minimum deposit amount?

- Is it safe to make deposits with Exness?

- How do I choose the best payment options for my needs?

- Common Deposit Queries Answered

- Understanding Your Deposit Process

- Exploring Your Exness Deposit Methods

- Fees, Limits, and Processing Times for Your Exness Deposits

- Security and Reliability of Your Funds

- Conclusion: Seamless Trading with Diverse Exness Deposit Methods

- Frequently Asked Questions

Understanding Exness Deposit Methods

Embarking on your trading journey requires a solid foundation, and part of that is confidently managing your capital. At Exness, we understand the critical role efficient and secure Exness deposit methods play in your trading experience. We’ve designed our system to be straightforward, offering a wide array of choices to help you easily fund your account and start trading without delay.

Choosing the right way to top up your account shouldn’t be a hassle. That’s why we provide diverse deposit methods, ensuring you find a perfect fit for your needs, no matter where you are in the world. Our focus is always on speed, security, and convenience.

Explore Your Payment Options

We believe flexibility is key. Our platform supports a comprehensive range of payment options, each designed to make your Exness deposits seamless. Here’s a glimpse into the popular choices available:

- Credit and Debit Cards: Instantly fund your account using widely accepted cards like Visa and Mastercard. It’s quick, secure, and incredibly convenient for most users.

- E-Wallets: For those who prioritize speed and digital convenience, popular e-wallets such as Skrill, Neteller, and Perfect Money offer almost instant transactions. These methods are a favorite for their efficiency.

- Bank Transfers: If you prefer traditional banking or need to deposit larger sums, bank wire transfers are a reliable option. While they may take a few business days to process, they offer a high level of security.

- Local Payment Solutions: We also integrate various regional payment systems to cater specifically to our global client base, offering localized convenience and familiar interfaces.

Key Considerations for Your Deposits

While exploring the various deposit methods, keep a few factors in mind to ensure the best experience:

| Factor | What to Know |

|---|---|

| Processing Time | Most methods offer instant processing, meaning your funds appear in your trading account almost immediately. Bank transfers might take 3-5 business days. |

| Deposit Fees | Exness typically charges no fees for deposits. However, your chosen payment service provider might levy their own charges, so always check with them. |

| Minimum & Maximum Limits | Deposit limits vary by method. We recommend checking the specific limits for your chosen option within your Personal Area. |

| Currency Conversion | If your deposit currency differs from your account currency, a conversion will occur, potentially involving a small exchange rate fee from your payment provider. |

We prioritize transparency and ease of access. You can always find detailed information about each of the Exness deposit methods directly within your Personal Area.

How to Fund Your Account

Making a deposit is a straightforward process:

- Log in to your Exness Personal Area.

- Navigate to the “Deposit” section.

- Select your preferred deposit method from the available payment options.

- Enter the desired deposit amount and follow the on-screen instructions specific to your chosen method.

- Confirm the transaction.

Our robust security protocols safeguard all your transactions, giving you peace of mind as you fund your account. With such a diverse and user-friendly system for Exness deposits, you can focus less on logistics and more on honing your trading strategies. Get ready to trade with confidence and convenience!

Overview of Available Exness Deposit Options

Navigating the world of online trading requires seamless financial operations. One crucial aspect traders often prioritize is the ease and variety of Exness Deposit Methods. We understand that quick, secure, and convenient funding is key to a smooth trading experience, and that’s exactly what you get when choosing your preferred method to fund account with Exness.

Exness offers an impressive array of payment options, catering to a global client base. These diverse options ensure you can select a method that best suits your location, financial preferences, and urgency. Our goal is to make your exness deposits as straightforward and hassle-free as possible, letting you focus on your trading strategies rather than logistical concerns.

Here’s a look at the primary categories of deposit methods you can expect to find:

- Bank Cards: Widely used and universally accepted, debit and credit cards like Visa and Mastercard offer a familiar and rapid way to make deposits directly from your bank account.

- Electronic Payment Systems (e-Wallets): For those who prefer digital convenience, popular e-wallets such as Skrill, Neteller, and Perfect Money provide swift transactions and often come with minimal fees, ideal for quick transfers.

- Bank Transfers: Traditional bank wire transfers remain a reliable choice for larger deposits, offering robust security, though processing times might be slightly longer depending on the banking institutions involved.

- Cryptocurrencies: Embracing modern financial trends, Exness supports deposits via various cryptocurrencies, providing a decentralized and often very fast funding alternative with increasing popularity.

Choosing the right deposit method is simple. Each option comes with clear details regarding processing times, potential fees (if any), and minimum/maximum limits right within your personal area. We empower you to easily manage your funds and ensure your trading account is always ready when opportunity strikes.

Bank Transfer Methods for Exness Accounts

Navigating the various Exness Deposit Methods can feel like a maze, but bank transfers remain a consistently reliable and secure choice. This traditional approach allows you to seamlessly fund your account, directly linking your personal bank with your Exness trading platform. It’s a method trusted by many for its robustness and transparency.

Why Bank Transfers Stand Out

When you’re looking to make significant Exness deposits or simply prefer a tried-and-true method, bank transfers offer distinct advantages:

- Unparalleled Security: Banks employ advanced encryption and fraud detection systems, providing a very high level of security for your transactions. Your funds are protected throughout the process.

- Higher Deposit Limits: For traders who manage larger capital, bank transfers often come with more generous deposit limits compared to other payment options. This makes it ideal for substantial fund account operations.

- Broad Accessibility: Nearly everyone has access to a bank account, making this method universally available across many regions.

- Direct Confirmation: You often receive direct confirmation from your bank once the transfer is initiated, giving you immediate proof of payment.

Understanding the Types of Bank Transfers

Bank transfers aren’t a one-size-fits-all solution. Depending on your location and bank, you might encounter different types:

- Local Bank Transfers: These are usually faster and might incur lower fees. They occur when both your bank and Exness’s processing bank are within the same country or economic zone. Processing times can often be within a few business hours or up to one business day.

- International Wire Transfers (SWIFT): Used for cross-border transactions, these can take longer to process, typically 3-5 business days. Fees might also be higher due to intermediary banks involved. However, they offer global reach, allowing you to fund your account from almost anywhere in the world.

How to Make Your Exness Deposit via Bank Transfer

Depositing funds into your Exness account using a bank transfer is a straightforward process:

- Log In to Your Personal Area: Access your Exness trading account.

- Select “Deposit”: Navigate to the deposit section.

- Choose “Bank Transfer”: From the list of available deposit methods, select the bank transfer option.

- Enter Deposit Amount: Specify how much you wish to fund your account with.

- Review Details: Exness will provide you with their banking details (bank name, account number, SWIFT code if international, beneficiary name).

- Initiate Transfer from Your Bank: Use your online banking portal, mobile app, or visit your local bank branch to make the transfer to the provided Exness details.

- Confirm and Wait: Once you initiate the transfer, Exness will typically credit your account upon receiving and confirming the funds.

Important Considerations for Bank Transfers

To ensure a smooth experience with your Exness deposits, keep these points in mind:

| Consideration | Details |

|---|---|

| Processing Time | Local transfers typically process faster (hours to 1 business day). International wires can take 3-5 business days. Plan accordingly. |

| Fees | Your bank may charge a fee for outgoing transfers. Exness generally does not charge deposit fees for bank transfers, but always check their current policy. |

| Currency Conversion | If your bank account currency differs from your Exness account currency, your bank may apply conversion rates and fees. |

| Reference Number | Always include any specific reference or comment provided by Exness when initiating the transfer. This helps them quickly identify and credit your funds. |

Bank transfers remain a preferred choice for many traders seeking robust, secure, and high-limit payment options. Explore these deposit methods with confidence to manage your trading capital effectively.

Local and International Wire Transfers

Wire transfers offer a time-tested, secure way to manage your Exness Deposit Methods. Whether you are funding your account domestically or from abroad, these methods provide a robust solution for adding capital to your trading journey. We will explore how these essential deposit methods work, their benefits, and what to keep in mind.

Local wire transfers typically mean moving funds within the same country. This often results in faster processing times and lower fees compared to international options. When you choose this method to fund account at Exness, your bank transfers money directly to Exness’s local bank account. It is a straightforward process, often completed within one business day, making it a convenient choice for many traders.

International wire transfers are ideal for larger sums and cross-border transactions. These exness deposits involve your bank sending funds to an Exness bank account located in a different country. This method leverages global banking networks, ensuring your money reaches its destination securely, albeit with potentially longer processing times. You will typically need SWIFT/BIC codes and IBAN details for these transactions, ensuring your funds go to the correct recipient.

Understanding the nuances of these payment options helps you make informed decisions:

- Security: Banks use advanced security protocols, making wire transfers one of the safest ways to move money.

- Limits: Wire transfers usually accommodate higher transaction limits, suitable for significant investments.

- Processing Time: Local transfers often clear within a day, while international transfers can take 3-5 business days, sometimes longer due to intermediary banks.

- Fees: Expect varying fees. Local transfers generally have lower costs, while international transfers might incur higher charges from both your bank and any intermediary banks involved.

| Pros of Wire Transfer Deposit Methods | Cons of Wire Transfer Deposit Methods |

|---|---|

| High security, backed by banks. | Slower processing, especially international. |

| Accommodates large deposit amounts. | Potentially higher transaction fees. |

| Widely accepted globally. | Requires more manual detail entry. |

To ensure a smooth experience when using wire transfers for your exness deposits:

- Always double-check all bank details provided by Exness before initiating a transfer.

- Allow for sufficient processing time, especially for international transfers, to avoid delays in trading.

- Confirm any potential fees with your bank beforehand to understand the total cost of your deposit.

- Ensure the name on your bank account exactly matches your Exness trading account name to prevent rejections.

Choosing wire transfers among the available deposit methods gives you a reliable path to funding your Exness account. They represent a robust solution for serious traders looking for secure and high-limit payment options.

Credit and Debit Card Deposits with Exness

Depositing funds into your trading account should be straightforward and secure. For many traders, credit and debit cards offer the most familiar and convenient way to manage their finances. Exness understands this need, providing seamless integration for card-based transactions.

Using your credit or debit card is one of the quickest ways to fund account balances and jump into the markets. Exness supports major card providers, ensuring broad accessibility for traders worldwide. This makes it a top choice among the various Exness deposit methods available.

How to Fund Your Account with Cards

The process to make Exness deposits using your card is designed for simplicity. Here’s a quick overview:

- Log in to your Personal Area on the Exness website.

- Navigate to the “Deposit” section.

- Select “Credit/Debit Card” from the list of payment options.

- Choose your trading account and currency.

- Enter the desired deposit amount.

- You’ll be redirected to a secure payment gateway to input your card details (card number, expiry date, CVV).

- Confirm the transaction. You might need to complete a 3D Secure verification, an extra layer of security provided by your bank.

Key Details for Card Deposits

When considering credit and debit cards for your Exness deposits, here are some important points to keep in mind:

- Supported Cards: Exness typically accepts Visa and MasterCard. Always check the latest information in your Personal Area for a full list.

- Processing Speed: Card deposits are usually instant, meaning your funds appear in your trading account almost immediately after successful transaction confirmation. This allows you to react quickly to market opportunities.

- Security: Exness employs advanced encryption protocols to protect your sensitive financial information during transactions. Your card details are processed securely.

- Currencies: Deposits can often be made in various currencies, which Exness will convert to your account’s base currency if necessary.

Pros and Cons of Using Cards for Deposits

It’s always good to weigh your payment options. Here’s a quick look at the advantages and potential drawbacks of using credit and debit cards:

| Advantages | Considerations |

|---|---|

| Instant processing times for quick funding. | Potential for bank-specific international transaction fees. |

| Widely accepted and familiar payment method. | Some banks may have daily transaction limits. |

| High level of security with advanced encryption. | Withdrawals typically must return to the same card used for the deposit. |

| No additional accounts or wallets needed. | May require 3D Secure verification, adding an extra step. |

Choosing credit and debit cards as your primary Exness deposit methods provides a reliable, fast, and secure way to manage your trading capital. Their widespread use and straightforward process make them an excellent option for funding your trading journey.

Popular E-Wallet Solutions

E-wallets have become a cornerstone of modern online transactions, offering unparalleled speed and convenience. For those managing their trading accounts, understanding the array of Exness deposit methods is crucial. E-wallet solutions stand out as a highly favored choice among traders looking to fund their account quickly and securely. They bridge the gap between your bank and your trading platform, streamlining the process of adding capital.

Why do so many traders gravitate towards these digital wallets for their Exness deposits? Here are the compelling advantages:

- Instant Funding: Most e-wallet transactions are processed almost instantly, meaning your funds appear in your trading account without delay. This allows you to seize market opportunities immediately.

- Enhanced Security: E-wallets add an extra layer of security, as your banking details are not directly exposed to multiple platforms. Your personal financial information remains private and protected.

- User-Friendly Interface: These payment options are designed for ease of use. Setting up an account and initiating transfers is straightforward, even for newcomers.

- Global Accessibility: Many popular e-wallets operate internationally, providing flexible solutions regardless of your geographical location.

When considering your deposit methods, popular e-wallet services often include names like Skrill, Neteller, Perfect Money, and WebMoney. Each offers a slightly different set of features but all prioritize efficient money movement. These diverse payment options ensure you can select a service that best aligns with your financial preferences and trading needs.

Here’s a quick look at why these specific e-wallet types are excellent for Exness deposits:

| E-Wallet Type | Key Benefit for Traders |

|---|---|

| Skrill/Neteller | Widely recognized, often instant processing, high security. |

| Perfect Money | Anonymity focus, flexible currency options, global reach. |

| WebMoney | Robust security, multi-currency wallets, established reputation. |

Utilizing these digital payment options to fund your account is incredibly simple. You choose your preferred e-wallet from the available Exness deposit methods, enter the amount you wish to transfer, and then confirm the transaction through your e-wallet’s secure portal. It’s a hassle-free way to ensure your trading capital is always ready when you need it. Embrace the convenience and efficiency that popular e-wallet solutions offer for all your Exness deposits.

Skrill and Neteller

For traders seeking rapid and secure ways to manage their funds, Skrill and Neteller stand out as two of the most preferred e-wallet solutions. These popular deposit methods provide a seamless experience for anyone looking to fund account with Exness.

Using Skrill or Neteller for your Exness deposits is straightforward. Once you select either of these payment options from your Personal Area, simply enter the desired amount and confirm the transaction through your e-wallet account. The process is designed for efficiency, ensuring your funds are available for trading almost instantly. These are reliable deposit methods that offer both speed and peace of mind.

- Speedy Processing: Enjoy near-instant crediting of your Exness account, letting you seize market opportunities without delay.

- Robust Security: Both Skrill and Neteller employ advanced encryption and fraud prevention measures to protect your financial information.

- Global Accessibility: These e-wallets are available in many countries, making them convenient for a wide range of traders.

- Flexible Limits: Exness accommodates various deposit limits through these services, catering to both new and experienced traders.

| Benefit | Consideration |

|---|---|

| Instant transfers for Exness deposits. | Potential e-wallet service fees on withdrawal. |

| Enhanced security features for your transactions. | Requires an existing Skrill/Neteller account. |

| Widely accepted globally. | Deposit limits may vary based on verification level. |

Choosing Skrill or Neteller among the Exness deposit methods means opting for convenience and speed. If you prioritize quick transactions and robust security when you fund your trading account, these e-wallets are excellent choices. Ready to experience seamless Exness deposits? Open your account today and explore these efficient payment options.

Other E-Wallets like Perfect Money

Beyond traditional banking, Exness understands the need for diverse and instant payment solutions. That is why they offer a comprehensive range of e-wallets, including popular choices like Perfect Money, making it easier than ever to fund your account.

E-wallets have become a go-to for many traders seeking speed and convenience when managing their funds. These digital wallets provide a secure bridge between your bank account or credit card and your trading account, streamlining the process of making Exness deposits.

When you explore the various Exness deposit methods, you will find that e-wallets often stand out for their efficiency. They are designed for quick transactions, ensuring your funds are available for trading almost instantly. This can be a significant advantage, especially in fast-moving markets where timing is crucial.

Why choose e-wallets for your Exness deposits?

- Instant Funding: Most e-wallet deposit methods process transactions immediately, so you can start trading without delay.

- Enhanced Security: E-wallet providers employ advanced encryption and fraud protection measures, adding an extra layer of security to your transactions.

- Convenience: Manage your funds easily from a single digital wallet, which often supports multiple currencies and other payment options.

- Privacy: Your bank details are not directly shared with the broker, maintaining a degree of financial privacy.

Exness offers a variety of these electronic payment options to cater to a global audience. While Perfect Money is a well-known example, you might find other similar services available depending on your region. Each of these deposit methods aims to provide a seamless experience when you want to fund account quickly and securely. Always check the specific terms and conditions for each payment option within your Exness personal area.

Cryptocurrency Deposits on Exness

Unlock the future of funding your trading account with Exness. When you explore the array of Exness Deposit Methods, cryptocurrency options stand out for their efficiency and modern appeal. This innovative approach allows traders to manage their funds with speed and security, embracing the power of digital assets. Making exness deposits via cryptocurrency offers a range of compelling advantages:- Speedy Transactions: Crypto networks often process transactions much faster than traditional banking systems, meaning your funds become available almost instantly.

- Enhanced Security: Blockchain technology provides a robust, encrypted environment for your transactions, adding an extra layer of security.

- Lower Fees: In many cases, cryptocurrency transfers involve lower transaction fees compared to wire transfers or other traditional payment options.

- Global Accessibility: Crypto transcends borders, offering a truly global method to fund account balances without geographical restrictions.

- Privacy: While not fully anonymous, crypto transactions offer a degree of privacy compared to conventional methods.

| Cryptocurrency | Network/Standard |

|---|---|

| Bitcoin (BTC) | Bitcoin Network |

| Ethereum (ETH) | ERC-20 |

| Tether (USDT) | ERC-20, TRC-20 |

| USD Coin (USDC) | ERC-20 |

Always verify the specific network or standard (like ERC-20 or TRC-20 for stablecoins) when initiating your exness deposits to avoid any issues. Sending funds on the wrong network could result in loss of your deposit.

- Double-check the wallet address before confirming any transaction. A single incorrect character can send your funds to an unrecoverable address.

- Be aware of network congestion, which can occasionally affect transaction times.

- Monitor the minimum and maximum deposit limits for each cryptocurrency, as they can vary.

- Always keep your personal crypto wallet secure with strong passwords and two-factor authentication.

Embracing cryptocurrency as one of your Exness Deposit Methods puts you at the forefront of financial technology. It offers a powerful, efficient, and secure way to fund account balances, keeping you focused on your trading journey. Explore these modern payment options today and experience the difference.

Using BTC, USDT, and Other Cryptos

Diving into modern financial solutions, Exness offers a seamless experience for those preferring digital currencies. Many find using BTC, USDT, and other cryptos among the most appealing Exness deposit methods available. This approach brings a new level of convenience and speed to managing your trading capital.

When you choose to fund account with cryptocurrencies, you unlock a realm of efficiency. Bitcoin (BTC) and Tether (USDT) stand out as popular choices for Exness deposits. They provide a robust and secure way to transfer funds directly into your trading account, often bypassing some of the traditional banking delays.

Here are some of the popular crypto payment options you can use:

- Bitcoin (BTC)

- Tether (USDT) ERC-20, TRC-20

- USD Coin (USDC) ERC-20

- Ethereum (ETH)

- Litecoin (LTC)

- Binance Coin (BNB) BEP20

These deposit methods are particularly beneficial for their global accessibility and speed. Transactions can process quickly, meaning your funds become available for trading without unnecessary waiting. The secure nature of blockchain technology adds an extra layer of confidence to your financial operations.

Opting for crypto payment options means you embrace the future of finance, ensuring your Exness deposits are handled with cutting-edge technology. It’s a straightforward process that positions you to react swiftly to market opportunities.

Minimum and Maximum Deposit Limits

Understanding the minimum and maximum deposit limits is crucial when you fund your account with Exness. These limits ensure smooth, secure transactions across all Exness Deposit Methods. Knowing these boundaries helps you plan your investments effectively, preventing any surprises when you make Exness deposits.

Several factors influence how much you can deposit. Your chosen deposit methods, the currency you use, your account’s verification status, and even your geographical location all play a role. We implement these measures to comply with financial regulations and protect both you and the platform.

Minimum Deposit Requirements

Exness aims for accessibility, offering flexible minimum deposit requirements. For many popular payment options, you will find these minimums quite low, making it easy to start trading. This approach ensures a wide range of traders can fund their account without a huge initial commitment. We want you to feel comfortable taking your first step.

While exact figures can shift, here is a general idea of how minimums might vary:

| Payment Option Type | Typical Minimum |

|---|---|

| Electronic Payment Systems | Often very accessible |

| Bank Transfers | Can be slightly higher |

Maximum Deposit Thresholds

You will find maximum deposit limits, on the other hand, typically much higher. These larger thresholds accommodate experienced traders and those looking to make substantial investments. For many Exness deposit methods, maximum limits can be very generous, especially once your account is fully verified. Verification plays a key role here, often unlocking higher limits and broadening your available payment options.

How to Check Your Specific Limits

You can best see your exact, up-to-date minimum and maximum limits directly within your Personal Area on the Exness website. Once logged in, navigate to the ‘Deposit’ section. You will clearly see the specific limits applicable to each of your chosen deposit methods. This personalized view ensures you always have the most accurate information at your fingertips for all your Exness deposits.

Ready to explore the flexible Exness Deposit Methods and fund your account? Understanding these limits is your first step towards a seamless trading journey. Dive in and discover the convenience firsthand!

Understanding Deposit Processing Times

In the fast-paced world of trading, every second counts. Knowing precisely when your funds will hit your trading account is crucial for seizing market opportunities. At Exness, we understand this urgency, and we’ve optimized our systems to ensure your Exness Deposit Methods are handled with incredible efficiency. Let’s demystify deposit processing times and help you manage your trading capital effectively.

What Influences Deposit Speed?

Several factors determine how quickly your funds reflect in your trading account. While we strive for instant processing on our end, external elements often play a role. Here are the key considerations:

- Your Chosen Deposit Method: Different payment options have varying inherent processing speeds, from immediate transfers to those requiring bank verification.

- Payment Provider Processing: Third-party payment systems and banks have their own protocols and daily cut-off times.

- Network Congestion: Occasionally, high transaction volumes on specific networks can cause minor delays.

- Verification Procedures: New payment methods or large deposits might trigger additional security checks for your safety.

Exness’s Commitment to Swift Deposits

Our goal is to make your exness deposits as seamless and quick as possible. We invest heavily in robust financial technology to minimize any waiting periods. Many of our available deposit methods offer instant processing, meaning your funds are available for trading almost immediately after you complete the transaction.

Typical Processing Times by Deposit Method

To help you plan, here’s a general overview of what you can expect when you fund account with various payment options:

| Deposit Method Category | Typical Processing Time | Notes |

|---|---|---|

| E-wallets (e.g., Skrill, Neteller, Perfect Money) | Instant | Funds typically appear in your account within seconds. |

| Cryptocurrencies (e.g., BTC, USDT) | Instant to a few minutes | Subject to blockchain network confirmation times. |

| Bank Cards (Visa, MasterCard) | Instant to a few minutes | Can sometimes take slightly longer due to bank authorization. |

| Bank Transfers | 1-3 business days | Dependent on interbank processing times; weekends and public holidays extend this. |

Always remember that “instant” refers to the time it takes for Exness to credit your account once we receive confirmation from the payment provider. Any initial delay would stem from the payment system itself.

Tips for Faster Deposit Processing

You can take a few simple steps to ensure your Exness deposits go through as quickly as possible:

- Use Verified Accounts: Ensure your payment method accounts are fully verified to avoid potential hold-ups.

- Check Availability: Confirm your chosen deposit methods are available in your region and currency.

- Adhere to Limits: Stay within the minimum and maximum transaction limits for each payment option.

- Double-Check Details: Always verify your transaction details before confirming to prevent errors that could delay processing.

We empower you with a range of secure and efficient payment options. Understanding these processing times lets you better strategize your trades and never miss out on market opportunities. Choose the Exness Deposit Methods that best fit your needs and experience seamless funding!

Exness Deposit Fees Explained

Navigating the world of online trading means understanding every aspect of your financial transactions, especially when it comes to funding your account. At Exness, we believe in transparency, making it easy for you to manage your capital without unexpected surprises. Let’s break down the fee structure for Exness deposits.

A significant advantage when using Exness is our commitment to providing zero fees on your deposits from our side. We want you to focus on your trading strategies, not on extra costs diminishing your investment.

While Exness typically does not impose charges on your Exness deposits, it’s crucial to understand that external factors can sometimes introduce costs. These potential fees usually originate from third-party services involved in the transaction:

- Bank Charges: Your bank or card issuer might apply fees for processing transactions, especially international transfers, or for certain types of payment options.

- Payment System Fees: Some third-party payment providers or e-wallets may have their own service charges for processing funds.

- Currency Conversion: If your deposit currency differs from your account’s base currency, a conversion will occur. While Exness offers competitive exchange rates, the provider or your bank may apply a spread or fee for this conversion.

We work hard to ensure you have a wide range of convenient deposit methods. Each of these payment options comes with its own set of characteristics regarding processing times and any potential third-party charges. Always review the details specific to your chosen method.

To give you a clearer picture, here’s a quick look at how potential fees might be structured:

| Fee Originator | Exness Policy for Deposits | What You Might See (External) |

|---|---|---|

| Exness Platform | Typically 0% fee | No direct charge on your deposit |

| Your Bank/Card Issuer | N/A (External entity) | Bank processing fees, international transfer fees |

| Selected Payment Provider | N/A (External entity) | Provider’s service charges, e-wallet fees |

| Currency Conversion | Competitive rates (may include spread) | Difference in exchange rate, bank conversion fees |

“We empower traders with transparent operations. Always check the specific details for your chosen deposit methods within your Exness Personal Area before you fund account. This gives you the most accurate and up-to-date information on any potential third-party charges.”

Our goal is to make your experience with Exness Deposit Methods as straightforward and cost-effective as possible. We encourage you to explore the diverse deposit methods available in your Personal Area. There, you will find precise information regarding minimums, maximums, and any specific external charges associated with each payment option. Ready to efficiently fund account and start trading? Discover the ideal method that suits your needs today!

Step-by-Step Guide: How to Deposit Funds

Ready to jump into the trading world? Adding funds to your Exness account is straightforward and fast. We’ve designed the process to be seamless, ensuring you can quickly fund your account and focus on your strategies. Exness offers a wide array of reliable Exness Deposit Methods, giving you flexibility and peace of mind.

Here’s a clear, step-by-step breakdown to guide you through making your Exness deposits:

Step 1: Log In to Your Personal Area

Your journey begins in your secure Exness Personal Area. Simply enter your registered email and password to gain access. This is your central hub for managing all aspects of your trading account, including your finances.

Step 2: Navigate to the Deposit Section

Once inside your Personal Area, look for the ‘Deposit’ button. You’ll usually find it prominently displayed on the left-hand menu or as a clear call-to-action on your dashboard. Click it to initiate the funding process.

Step 3: Select Your Preferred Payment Option

This is where you choose how you want to add money. Exness provides numerous deposit methods tailored to suit various preferences and regions. Whether you prefer traditional banking or modern e-wallets, you’ll find a suitable option. Review the available payment options carefully, considering factors like processing time and any potential fees.

- Bank Cards (Visa, MasterCard)

- E-Wallets (Skrill, Neteller, Perfect Money, WebMoney)

- Bank Transfers

- Local Payment Solutions

We work hard to ensure a diverse range of Exness Deposit Methods is always available for your convenience.

Step 4: Enter Deposit Details

After selecting your desired payment option, you will specify the amount you wish to deposit and your preferred currency. Double-check all details before proceeding. Some deposit methods may have minimum or maximum limits, which the system will display clearly.

Here’s an example of what to expect:

| Field | Input |

| Deposit Amount | [Your Desired Amount] |

| Currency | [Your Account Currency] |

Always ensure the deposit currency matches your trading account currency to avoid conversion fees.

Step 5: Confirm Your Transaction

Review all the information one last time. If everything looks correct, confirm your transaction. Depending on your chosen payment method, you might be redirected to a secure payment gateway to complete the authorization. Follow the on-screen prompts carefully to finalize your Exness deposit.

That’s it! Your funds will typically appear in your trading account shortly, allowing you to begin trading without delay. We strive for instant processing for most deposit methods, so you can seize market opportunities as they arise.

Security Measures for Your Exness Deposits

When you’re ready to fund account and dive into the world of trading, security isn’t just a buzzword – it’s the bedrock of your confidence. At Exness, we understand this completely. That’s why we’ve put robust security measures in place, ensuring every one of your Exness deposits is handled with the utmost care and protection. We want you to focus on your trading strategy, not worry about the safety of your funds.

Advanced Encryption and Data Protection

Your digital security is non-negotiable. Every piece of information, from your personal details to your transaction data, travels through secure, encrypted channels. We use industry-standard SSL (Secure Socket Layer) technology, turning your data into an unreadable code during transmission. This keeps your sensitive information safe from prying eyes, making your deposit methods inherently secure from the moment you initiate them.

- SSL Encryption: All data transfers are protected by powerful encryption protocols.

- Firewall Protection: Our systems are shielded by advanced firewalls, blocking unauthorized access attempts.

- Regular Audits: Independent security experts routinely audit our platforms to identify and fix potential vulnerabilities.

Regulatory Compliance and Fund Segregation

We operate under strict regulatory frameworks across various jurisdictions. These regulations don’t just ensure fair trading; they also mandate stringent financial security practices. One of the most critical safeguards is fund segregation. This means your deposited funds are kept entirely separate from Exness’s operational capital. Should anything unexpected happen to the company, your money remains untouched and accessible.

“Your peace of mind is our priority. We adhere to global financial standards to safeguard every Exness deposit.”

Personalized Account Protections

Beyond our system-wide security, we empower you with tools to protect your individual account. These personalized safeguards add an extra layer of defense, making it incredibly difficult for unauthorized parties to access your funds or personal data, regardless of the payment options you choose.

- Two-Factor Authentication (2FA): Add an essential second step to your login process. A code sent to your mobile device or email ensures only you can access your account.

- Transaction Verification: For significant actions, including withdrawals, we require additional verification, confirming it’s truly you making the request.

- Real-time Monitoring: Our security team actively monitors for unusual activity, flagging and investigating anything that seems out of the ordinary immediately.

Secure Payment Options and Vetted Partners

The Exness deposit methods available are carefully selected and integrated with security in mind. We partner exclusively with trusted, globally recognized payment providers who themselves employ robust security protocols. This collaborative approach means your funds are protected not just by us, but also by the industry’s leading financial institutions.

Here’s how we ensure secure payment processing:

| Security Aspect | Our Commitment |

|---|---|

| Verified Gateways | Only reputable, secure payment processors are integrated. |

| Anti-Fraud Measures | Sophisticated systems detect and prevent fraudulent transactions. |

| Privacy Protection | Your payment details are never stored directly on our servers. |

Your financial security is a responsibility we take seriously, from the moment you explore our deposit methods to every successful trade you make. Ready to experience a trading environment where security is paramount? Join Exness and fund account with complete confidence today!

What to Do If Your Deposit Has Issues (Troubleshooting)

Encountering hurdles with your Exness deposits can be frustrating, especially when you’re keen to fund account swiftly. Don’t worry; most issues are easily resolved with a few simple steps. Here’s a clear guide to troubleshooting common problems that might arise with your Exness Deposit Methods.

Before you contact support, start with these quick checks:

- Review Transaction Details: Did you enter the correct amount, account number, or card details? Even a tiny typo can cause a hold-up.

- Check Your Internet Connection: A stable connection is crucial for successful online transactions.

- Verify Wallet/Bank Balance: Ensure sufficient funds are available in your chosen payment option.

- Payment Method Limits: Have you exceeded any daily or transaction limits set by your bank or e-wallet?

Often, a deposit issue stems from common processing errors. Understanding these can help you act quickly. Many common issues relate directly to the chosen deposit methods, so a quick review of your specific method’s requirements can often provide clues.

| Problem | Quick Solution |

|---|---|

| Deposit Declined | Contact your bank or payment provider to understand why. Ensure you haven’t hit daily limits. |

| Funds Not Reflected | Check the processing time for your specific Exness Deposit Methods. Some can take longer than others. Keep your transaction ID handy. |

| Incorrect Amount Deposited | Immediately contact Exness support with your transaction details. Do not attempt further transactions until this is resolved. |

Always double-check the specifics of your chosen payment options. Each service has its own nuances and requirements. Being proactive here can save you time and frustration.

“A smooth deposit starts with careful preparation. Understanding your chosen Exness Deposit Methods beforehand is key to avoiding common pitfalls.”

If you’ve completed all these checks and your Exness deposits still face an issue, it’s time to reach out to the Exness support team. They are equipped to investigate more complex problems. When contacting them, have the following information ready:

- Your Exness account number.

- The exact date and time of the failed deposit.

- The specific amount you attempted to deposit.

- The payment method used (e.g., bank transfer, e-wallet, card).

- Any error messages or screenshots you received.

- Your transaction ID, if available.

For future deposits, consider reviewing all available Exness Deposit Methods. Understanding their individual processing times and potential fees can help you choose the most suitable option, ensuring a seamless experience every time you fund account.

Choosing the Right Exness Deposit Method

When it comes to managing your trading funds, selecting the ideal Exness Deposit Method is a crucial decision. It is not just about getting money into your account; it is about speed, convenience, and security. Understanding the various payment options available empowers you to make smart choices for your trading journey.

What truly makes one deposit method better than another for your specific needs? Consider these vital factors before you fund account with Exness.

- Processing Speed: Time is money, especially in trading. Many Exness deposits are instant, but some methods can take longer. Knowing the expected processing time for each payment option is key.

- Transaction Fees: While Exness often offers zero-commission deposits, certain deposit methods or your payment provider might impose their own charges. Always check for any potential fees to avoid surprises.

- Security Measures: Your financial safety is paramount. Exness employs robust security protocols, but choosing a deposit method known for its strong encryption and fraud protection adds an extra layer of peace of mind.

- Geographic Availability: Not all Exness Deposit Methods are available worldwide. What works for one trader in Europe might not be an option for another in Asia. Confirm that your preferred method is supported in your region.

- Minimum and Maximum Limits: Each payment option comes with its own set of transaction limits. Whether you are starting small or making a substantial deposit, ensure the chosen method accommodates your financial plan.

Exness prides itself on offering a diverse range of deposit methods to cater to traders globally. This variety ensures you can fund account conveniently and efficiently. Here are some of the popular payment options you will encounter:

| Deposit Category | Description |

|---|---|

| Bank Cards | Visa and Mastercard are widely accepted, offering a familiar and straightforward way to make your Exness deposits. |

| E-Wallets | Digital wallets like Skrill, Neteller, and Perfect Money provide quick and secure transactions, often favored for their speed and ease of use. |

| Online Bank Transfers | For those who prefer direct bank-to-bank transactions, this deposit method is available, though processing times can vary. |

| Local Payment Solutions | Depending on your region, Exness integrates with various local payment options, making it easier to fund account using methods familiar in your country. |

Take the time to review the specific details for each Exness Deposit Method within your personal area. Your ideal choice will align with your financial goals, regional access, and personal preference for speed and security. Make an informed decision and start trading with confidence!

Exness Deposit Methods: Frequently Asked Questions

Navigating the financial markets requires not just strategic insight but also reliable and convenient ways to manage your capital. Understanding the available Exness Deposit Methods is a crucial first step for any trader looking to begin or continue their journey. We’ve compiled a list of frequently asked questions to help you effortlessly fund your account, ensuring you have all the information you need to make informed decisions about your payment options.

What are the primary Exness Deposit Methods available?

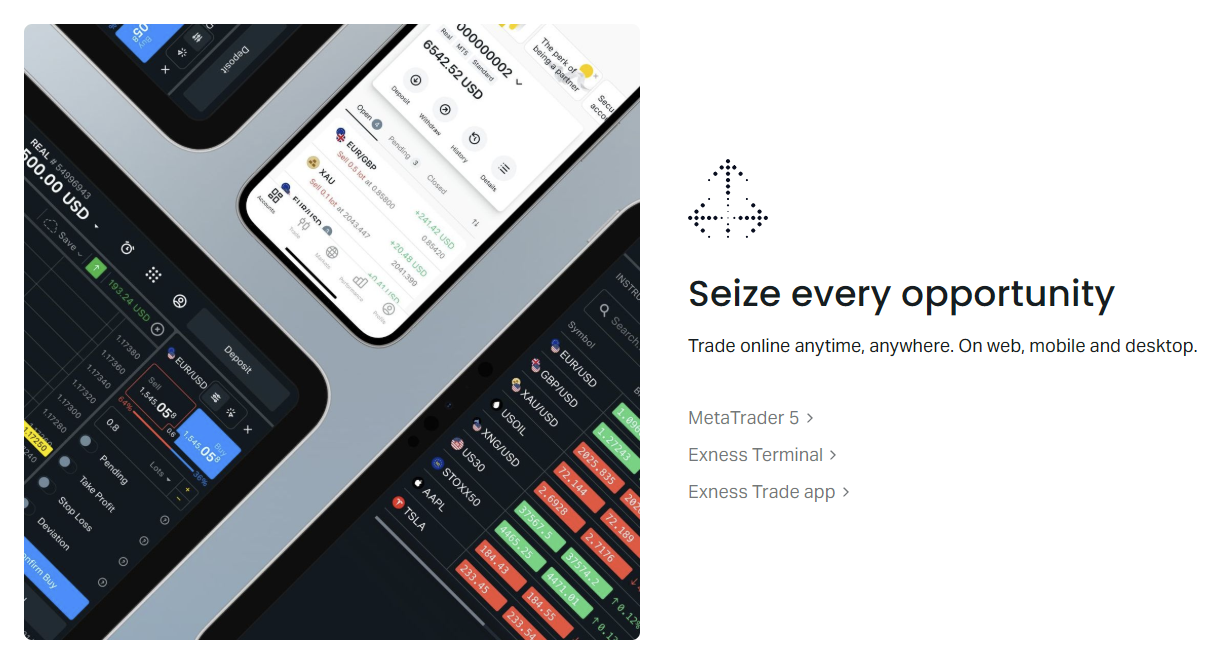

Exness offers a wide array of deposit methods designed for global accessibility and user convenience. You can typically find options ranging from traditional bank transfers and credit/debit cards to various electronic payment systems and even cryptocurrencies in some regions. The specific payment options available to you will depend on your country of residence, but the goal is always to provide flexible and secure ways for Exness deposits.

How do I fund my account with Exness?

Funding your Exness account is a straightforward process. Once you’ve registered and verified your account, log in to your Personal Area. Navigate to the ‘Deposit’ section, where you will see a list of available deposit methods tailored to your region. Simply choose your preferred option, enter the desired amount, and follow the on-screen instructions to complete your transaction. It’s designed to be intuitive, getting you ready to trade without unnecessary delays.

Are there any fees associated with Exness deposits?

Exness prides itself on offering commission-free Exness deposits for most of its payment options. This means that when you decide to fund account, you typically won’t incur additional charges from Exness itself. However, it’s always wise to check with your specific payment provider (e.g., bank, e-wallet service) as they might impose their own transaction fees. The platform aims for transparency, so any potential fees will usually be highlighted before you finalize your deposit.

What are the typical processing times for Exness Deposit Methods?

The processing times for Exness deposit methods vary depending on the chosen option. Many electronic payment systems, such as e-wallets, offer instant deposits, meaning your funds appear in your trading account almost immediately. Bank transfers, on the other hand, might take anywhere from a few hours to several business days due to bank processing times. Credit and debit card deposits are generally fast, often reflecting within minutes. Exness works hard to ensure all deposits are processed as quickly and efficiently as possible, keeping you ready for market opportunities.

What is the minimum deposit amount?

The minimum deposit amount at Exness is highly flexible and often depends on the chosen deposit method and account type. For many popular payment options, the minimum can be quite low, making it accessible for traders of all levels to fund account. For example:

| Deposit Method | Typical Minimum (Approx.) |

|---|---|

| E-Wallets (e.g., Skrill, Neteller) | $10 |

| Credit/Debit Cards | $10 |

| Bank Wire Transfers | $50 – $200 (Varies by bank) |

Always check the exact minimum for your selected method within your Personal Area, as these figures can fluctuate slightly.

Is it safe to make deposits with Exness?

Absolutely. Security is a top priority for Exness. The platform employs advanced encryption technologies and robust security protocols to protect your personal and financial information during all transactions. When you use the various deposit methods, your data is safeguarded, ensuring a secure environment for all your Exness deposits. You can trade with peace of mind, knowing your funds are handled with the utmost care and protection.

How do I choose the best payment options for my needs?

Choosing the best payment options depends on your individual priorities. Consider the following factors:

- Speed: If instant access to funds is critical, opt for e-wallets or credit/debit cards.

- Fees: While Exness offers commission-free deposits, check for any fees imposed by your bank or payment provider.

- Convenience: Select a method you are already familiar with and use regularly.

- Availability: Ensure the method is supported in your region.

Exness provides diverse payment options to accommodate a wide range of preferences, helping you manage your funds effectively.

Common Deposit Queries Answered

Navigating your financial transactions should be straightforward and stress-free. We understand you might have questions about funding your trading account, and we are here to provide clear, concise answers to your most common deposit queries. Our goal is to ensure you can confidently fund account with ease, knowing all your questions about Exness Deposit Methods are covered.

Understanding Your Deposit Process

Adding funds to your Exness account is designed to be simple. You initiate the process directly from your Personal Area. Once there, you select “Deposit” and choose your preferred method from the available payment options. Follow the on-screen instructions, confirm the details, and your funds will soon reflect in your trading account. It’s a seamless journey crafted for your convenience.

Exploring Your Exness Deposit Methods

We offer a diverse range of Exness deposit methods to cater to various preferences and regional requirements. Whether you prefer traditional banking or modern digital solutions, you will find a suitable option. Each method offers different processing times and potential limits, giving you the flexibility you need.

Here’s a quick overview of the types of payment options you might encounter:

| Deposit Method Type | Typical Processing Time | Common Availability |

|---|---|---|

| Electronic Wallets | Instant to a few hours | High |

| Bank Cards (Credit/Debit) | Instant to a few hours | High |

| Bank Transfers | 1-3 business days | Moderate |

Fees, Limits, and Processing Times for Your Exness Deposits

Transparency is key when it comes to your money. We strive to keep fees at a minimum, and often, many Exness deposits are processed without any commission from our side. However, your chosen payment provider might impose their own charges, so always check their terms.

Regarding limits, these vary based on the specific deposit methods and your verification level. You will see the exact minimum and maximum amounts applicable to your chosen method directly in your Personal Area before you confirm your transaction. Most electronic Exness deposit methods offer instant processing, meaning your funds appear in your trading account almost immediately. Bank transfers, by their nature, can take a few business days to clear.

Security and Reliability of Your Funds

Your financial security is our top priority. We employ advanced encryption technologies and adhere to strict regulatory standards to protect your funds and personal information. Every transaction, regardless of the deposit methods you choose, is handled with the utmost care and security protocols. You can rest assured that when you fund account with Exness, your money is in safe hands.

For any specific questions not covered here, our dedicated support team is always ready to assist you, ensuring a smooth and confident trading experience.

Conclusion: Seamless Trading with Diverse Exness Deposit Methods

Navigating the financial markets demands both precision and flexibility. When it comes to managing your trading capital, the ease and security of your funding process are paramount. Exness understands this critical need, offering a comprehensive suite of Exness Deposit Methods designed to ensure a smooth, secure, and swift experience for every trader.

The variety of deposit methods available empowers you to choose the option that best suits your needs, no matter where you are in the world. From traditional banking solutions to modern e-wallets, the flexibility in payment options means you can effortlessly fund account and get straight to trading without unnecessary delays.

Here’s why the thoughtful selection of Exness deposits stands out:

- Instant Funding: Many options process transactions immediately, allowing you to seize market opportunities without waiting.

- Robust Security: Advanced encryption and security protocols protect your financial data and transactions, giving you peace of mind.

- Zero or Low Fees: Exness is committed to transparency, often providing commission-free deposits, so more of your capital goes towards your trading.

- Global Accessibility: A wide range of localized and international payment solutions ensures convenience for traders worldwide.

- User-Friendly Process: Simple, intuitive steps guide you through each deposit, making the experience hassle-free even for beginners.

“Your trading journey should be about market analysis and strategy, not about wrestling with payment systems. Exness’s commitment to diverse and efficient deposit methods lets you focus on what truly matters.”

Ultimately, the extensive range of Exness Deposit Methods is a testament to the platform’s dedication to trader convenience and satisfaction. It’s about empowering you with the tools to manage your funds efficiently, ensuring that when opportunity knocks, you’re ready to answer. Experience seamless financial operations and unlock your trading potential today.

Frequently Asked Questions

What are the primary Exness deposit methods available?

Exness offers a wide array of deposit methods including traditional bank transfers, credit/debit cards (Visa, MasterCard), various electronic payment systems (Skrill, Neteller, Perfect Money), local payment solutions, and cryptocurrencies (Bitcoin, Tether, etc.).

Are there any fees associated with Exness deposits?

Exness typically offers commission-free deposits, meaning they do not charge fees from their side. However, your bank, card issuer, or chosen third-party payment provider might impose their own transaction or currency conversion fees.

How long do Exness deposits take to process?

Processing times vary by method. Many electronic payment systems and credit/debit card deposits are instant, with funds appearing almost immediately. Cryptocurrency deposits are usually instant to a few minutes, subject to blockchain confirmation. Bank transfers typically take 1-3 business days.

What are the minimum and maximum deposit limits?

Minimum and maximum deposit limits are flexible and depend on the chosen deposit method, currency, account verification status, and geographical location. Exness aims for accessibility, with many methods having low minimums. Specific limits can be checked in your Personal Area.

How does Exness ensure the security of my deposits?

Exness employs robust security measures including advanced SSL encryption for data protection, stringent regulatory compliance, fund segregation (keeping client funds separate from company capital), and personalized account protections like Two-Factor Authentication (2FA). They partner with trusted payment providers, ensuring secure payment gateways.